Asia Pacific look towards embracing technologies to advance their digital transformation strategy: F5 Networks survey

Asia Pacific organisations are keenly taking advantage of embracing emerging technologies to accelerate their digital transformation projects. F5 Networks’ (NASDAQ: FFIV) latest 2019 State of Application Services report revealed that 41 percent of Asia Pacific organisations are employing containers, and taking advantage of agile development methodologies to deliver applications smarter and faster. While such shifts present new opportunities for automation and agility, complexity levels also arise; leaving organisations with additional challenges such as enforcing consistent security and optimising reliable performance standards. “As Asia Pacific businesses look to further advance their ongoing digital transformation initiatives, the ability to modernise its application portfolio and infrastructure is taking center stage,” said Adam Judd, Senior […]

FPA launches fintech assistance

Attempting to offer guidance in the maze of fintech products on the market, the Financial Planning Association (FPA) has launched an online solution to help identify which ones would most improve the profitability and efficiency of planning practices. The diagnostic tool would quantify the actual costs and time involved in providing advice services and provide a basis for calculating how to price offerings accordingly. It was developed with advice technology producer YTML. FPA chief executive, Dante Do Gori, said that this would help planners get a clearer picture of the time and costs involved in advice to allow them to choose the tech solutions that would benefit them most, noting […]

RepuCoin secure blockchain defends against attackers

In what its originators have billed as a ‘world first’, a secure blockchain has been developed that they claim can defend against malicious activity. Monash University researchers are part of an international team that created the system, which, it is claimed, can successfully block malicious activity by attackers who possess more than half of the system’s computing power. The system, RepuCoin, introduces the concept of ‘reputation’ to blockchain, supposedly making it thousands of times more expensive to attack than Bitcoin. Its creators claim it has the potential to be applied in a number of global sectors including fintech, energy, food supply chains, health care and future 5G telecommunications networks. RepuCoin’s […]

Digital wallets at ‘tipping point’, says ME Bank

The use of digital wallets is at a “tipping point” and customers will soon expect all banks to provide such services, says Members Equity Bank, as its decision to develop the smart phone technology dented first-half profits. As the lender delivered results that showed it was winning market share but facing skinnier profit margins, chief executive Jamie McPhee also said he thought the housing downturn had further to run, tipping house price falls of another 5 to 10 per cent. The industry-fund owned bank, known as ME, booked a $5 million impairment in its first-half result as it stopped work on its credit card platform to divert funds to work […]

Why more Aussies are turning to peer-to-peer loans

The Royal Commission into the banks and financial services unveiled a series of disturbing, infuriating and unsurprising truths. Australia’s response to the findings could send tremors through the financial services sector as the search for alternatives to the incumbent providers becomes more urgent. It means peer-to-peer loans – which have already seen significant gains – could become even more prominent in the lending landscape, the CEO of peer-to-peer loan provider SocietyOne, Mark Jones believes. SocietyOne is an online peer-to-peer loan platform, connecting investors’ funds with borrowers’ needs. The majority of loans SocietyOne writes are personal loans. Speaking to Yahoo Finance, Jones said Australians have been resigned to accessing credit from […]

Blockchain payment solutions that simplify travel transactions

Fenex – a blockchain-powered payment and services solution for the travel and hospitality industry that provides a network of payment products to simplify B2B travel transactions. Fenex’s range of products will serve travel agents, hotels, airlines and tourism experience providers looking to speed up payment settlements, automate processing, reduce transaction fees and generate additional revenue opportunities. These products include the patent pending blockchain powered digital business to business payment platform (dB2B), BlocRec, and BlocTic, among others. Today, the current structure of the credit card issuance and acceptance costs in the hospitality industry can be as complicated as a 16-step process. Fenex is out to simplify this for its partners, offering […]

Automic Group appoints FinTech leader Astrid Raetze to accelerate growth

Automic Group announces the appointment of Astrid Raetze as an Executive Director. A tech company that provides a unique ecosystem of share registry, company secretarial, legal and finance services, and which already services more than 10 per cent of ASX listed companies, Automic is delighted to celebrate the appointment of an exceptional leader. Astrid was previously a partner at KPMG, where she was the Australian Head of FinTech. She has more than 20 years of experience in the finance and legal industries, including a long tenure with Baker & McKenzie where she was the Global Head of FinTech, a member of the Global Innovation Committee and the Australian lead for […]

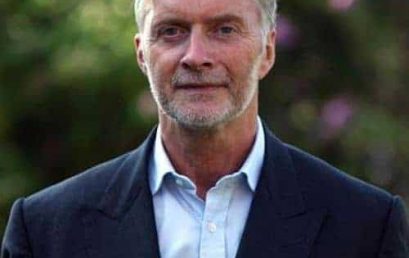

Interview: Anthony Thomson, 86 400 – roaming numerals

In an exclusive interview, Anthony Thomson, chairman of Australian challenger bank 86 400, tells FinTech Futures about what makes it different from its rivals, and why the big four Down Under got what they deserved. Most people don’t want to be the same as others and strive to be different and stand out. For challenger bank 86 400 (pronounced eighty-six, four-hundred), up against plenty of other Australian rivals such as Xinja and Volt, Thomson wants to make it known about its distinctive qualities. “Unlike others, we made the decision to apply directly for a full banking licence, rather than piggyback off another licence, or via the restricted licence route.” The […]