How will the escalating deployment of mobile wallets help enhance consumer experience and sustain business growth?

Over the past decade, mobile connectivity has given rise to innumerable business opportunities and consumer-centric developments, the mobile wallet being one of them, that have grown beyond expectations. From taking low quality pictures to QR code scanning and from mere internet browsing to digital payment applications, mobile phone technology has significantly advanced to deliver more convenience to users as fast as possible. As money transactions are an obligatory part of everyday life, they represent a boundless potential for different payment solutions to be utilized in various commercial settings. One can say that initially, e-commerce platforms had already laid down the foundation and shown the viability of secure online payments, inspiring […]

Fintech unveils mortgage under 3.5%

Fintech and online lender loans.com.au has unveiled its newest home-loan offering for owner-occupiers with a low interest rate of 3.48%. Dubbed the Smart Home Loan, the mortgage product is a principal-and-interest loan that has no ongoing fees and has a comparison rate of 3.5%. The product has a maximum loan amount of $1m and has several features such as redraw facilities and the ability to split and make additional repayments. Homebuyers can borrow as much as 80% of the value of their targeted property. Loans.com.au managing director Marie Mortimer said the new home-loan product aims to drive competition in the mortgage space and provide other options for borrowers who are […]

Novatti just started making pots of money from its Alipay bill website

Novatti isn’t buying Australian milk to send to China, but has found another way to tap the moneyed Chinese population at home and overseas. The company says its gamble on a payments service for China residents to pay bills in Australia is paying off so well they’re looking at transaction volumes rising from $460,000 in January 2019 to an estimated $700,000 in February. In the December quarter the dollar value of transactions still only averaged $200,000 a month. As to the reasons for the pick-up? Novatti CEO Peter Cook attributed it to an increasing level of trust as the product spends more time on the market. “We think it’s partly […]

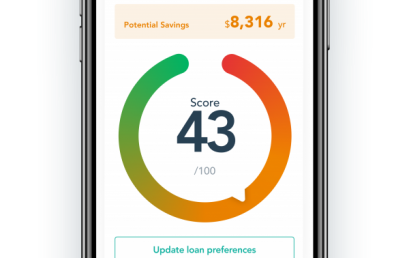

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

HSBC used blockchain to settle $250B worth of trades

HSBC has settled $250 billion worth of forex trades using blockchain in the last year, it said on Monday, suggesting the heavily hyped technology is gaining traction in a sector until now hesitant to embrace it. The bank has settled over three million forex trades and made over 150,000 payments since February using blockchain, it said in a statement. HSBC would not give data on forex trades settled by traditional processes, saying only that those settled by blockchain represented a “small” proportion. Still, the data marks a significant milestone in the use of blockchain by mainstream finance, which has until now been reluctant to start using the technology at any […]

86 400 marks completion of key milestones on road to public launch in 2019

86 400, a genuine alternative to Australia’s Big Four Banks, can today disclose that it has successfully achieved a number of key milestones as part of its mission to give Australians a better banking experience. The major milestones that the aspiring bank has completed since unveiling include: Product: Field testing of the beta 86 400 app with staff during Q4 2018 — as committed to during June’s unveiling Testing of the 86 400 debit card, Apple Pay, Google Pay and Samsung Pay across Australia and overseas 86 400’s Core Banking Platform sourced from its Australian banking technology partner Data Action has been operational for a number of months. All payment rails […]

Will Australians trust startups with their money as the cashless economy takes hold?

F5 Networks today announced new research showcasing that while Australians are moving towards a cashless economy, they remain divided when it comes to the future of payments. The study, The Changing Face of Payments & The Rise of the Cashless Economy, revealed over a third (34%) of Australians wouldn’t trust a startup with their money despite 58% of people using digital banking apps today. The F5 research explores the intersection between traditional and digital transactions with 60% of Australians indicating their behaviour will be guided by security. This builds on F5’s earlier Curve of Convenience survey, where 63% of Australian respondents emphasised valuing security over convenience. Jason Baden, Regional Vice President, AN/Z of F5 Networks commented, “With a major shift to […]

CBA ramps up blockchain

Commonwealth Bank is close to completing more blockchain projects, after it delivered the world’s first blockchain bond with World Bank in August. Speaking at SIBOS, Sophie Gilder who is CBA’s head of experimentation and commercialisation for blockchain, embodied AI and emerging technology said CBA has a portfolio of blockchain projects. Some of these are at very early stages where the bank is trying to determine if they are worthwhile to take forward or not. Others are at a pilot stage where the bank has been through successful proof of concept, has demonstrated the feasibility of the technology being applied to a particular problem and is taking the project to the […]