Mortgage aggregator Finsure expands lending panel through partnership with Banjo Loans

Leading mortgage aggregator network Finsure has welcomed Banjo Loans on their panel to expand its SME business lending offering.

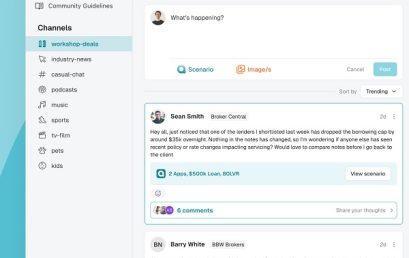

Quickli launches in-built mortgage broker Community

Quickli has launched a mortgage broker community engagement function on its widely-used interface at no extra charge, dubbed the Quickli Community.

Mortgage Choice announces strategic partnership with tech provider NextGen

Mortgage Choice have announced a new partnership with technology provider NextGen, which marks the first phase of integrating open banking into the Mortgage Choice home loan application process.

Boosting Loan Origination in 2025: 5 critical insights from the Sydney FST Banking Summit

Sandstone Technology recently took part in the FST Banking Summit 2025 where industry leaders gathered to discuss the future of financial services.

Pearler launches HomeSoon to make your super work for you to buy your first home sooner

Pearler HomeSoon is purpose-built to help young Australians grow their first home deposits through their super account.

Lextech strengthens leadership with CTO and CFO appointments

Lextech, together with law firm Purcell Partners, have announced the appointment of two senior executives to support its next phase of growth.

Designing Voice AI for Home Loans: Humanistic conversations without the deception

Craggle’s voice AI listens like a human. It understands the intention behind the statement and can match it to the appropriate feature.

10th Annual FinTech & Banking Awards 2025 – Now open for submissions!

Australia’s first and oldest FinTech & Banking Awards, the 10th Annual FinTech & Banking Awards 2025, are now open for submissions.