Designing Voice AI for Home Loans: Humanistic conversations without the deception

Craggle’s voice AI listens like a human. It understands the intention behind the statement and can match it to the appropriate feature.

10th Annual FinTech & Banking Awards 2025 – Now open for submissions!

Australia’s first and oldest FinTech & Banking Awards, the 10th Annual FinTech & Banking Awards 2025, are now open for submissions.

Bridging the Financial Divide: The untapped opportunity for inclusive growth in Australia

As Australia looks to shape its economic future under new leadership, financial inclusion is once again front and centre.

Introducing Australian FinTech’s newest Member – Craggle

Craggle is an Australian fintech that was born to simplify every step of the home lending process and deliver better rates to Australians.

Lextech exits ELNO race

Lextech has announced it is withdrawing its application to be an Electronic Lodgment Network Operator (ELNO).

RedZed enhances broker experience with groundbreaking serviceability platform, powered by Quickli

RedZed, a lender for the self-employed, have today announced the launch of its brand-new serviceability calculators developed by Quickli.

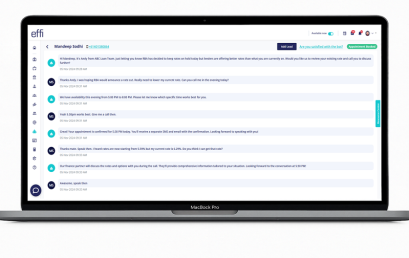

This Broker let AI do the talking – The results? Game-changing

A Melbourne-based broker has successfully refinanced more than $20 million in loans by utilising an AI-powered virtual assistant built by fintech startup Effi Technologies.

Australian fintech Lextech announces new CEO and leadership

Leading mortgage processing and legal services provider Lextech and Purcell Partners have announced key leadership appointments to support continued customer growth and innovation.