Banks need to contend with YOLO and FOMO for market share

The attitudes and expectations of Millennials are shaping up as a key hurdle for banks, as younger customers experiment with new financial service providers and defer major investment decisions such as property purchases. Consultants at KPMG say the results mean that banks will have to learn the meaning of YOLO (you only live once) and the importance of FOMO (fear of missing out) in order to adapt their strategies and capture this valuable demographic. The findings are contained in the consultant’s third annual survey of the banking habits of Generation Y titled “Banking on the Future” which surveyed 1400 professionals aged between 18 and 30 years old. In what amounts […]

NRMA Business Insurance partners with Prospa to lend a hand to small business owners

With cash flow and financial responsibilities being two of the most common things keeping business owners awake at night, NRMA Business Insurance has entered into a pilot partnership with small business lender Prospa to offer customers a faster, simpler finance solution. Prospa is an online small business lender and one of the fastest growing technology businesses in the country. It offers small business owners the flexibility and ease of accessing business loans between $5,000 to $250,000 online, with approval within a day. Through the partnership, NRMA Business Insurance customers can now access Prospa’s lending services alongside other benefits offered by the insurer, such as free online tax and […]

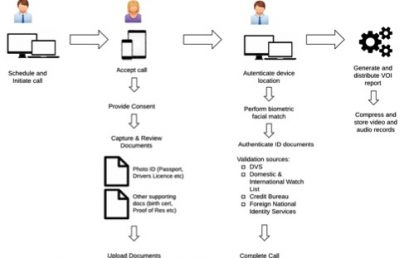

Regtech player e4 introduces Australia’s first-ever Virtual ID solution

South African regulation technology company e4 has arrived in Australia with the promise of enhanced corporate regulatory compliance and superior customer convenience, thanks to its introduction of Australia’s first real-time, ‘virtual’ alternative to face-to-face ID verification. e4’s new Virtual VOI (Verification of Identity) platform delivers Australian businesses the first ever digital opportunity to ensure compliance with global and local anti-money laundering and counterterrorism financing (AML/CTF) standards, increased customer and workforce convenience and a substantial saving against other ID verification services in operation across the country. Founded in 2000, the e4 Group has already become a dominant and trusted software and technology services provider to the banking, legal and […]

ATM use hits 15-year-low as shift to cashless society gathers momentum

ATM withdrawals have slumped to their lowest levels in 15 years and the number of Australians taking cash out during debit card transactions is falling at the fastest annual rate on record. The new figures provide an insight into the wider shift towards a cashless economy, as electronic payments such as Paypass transform habits and consumers shy away from ATM withdrawal fees and bricks-and-mortar branches. According to Reserve Bank of Australia figures released on Monday, the number of ATM withdrawals in January fell by 7.7 per cent compared to last year. The total value was down by 3.9 per cent. It follows two consecutive years of ATM withdrawals falling by […]

The Benzinga Global Fintech Awards – entries closing soon

The Benzinga Global Fintech Awards May 11, 2017 in New York, is the premier event in Fintech, celebrating financial innovation from around the world. The Benzinga Awards is a competition to showcase the companies with the most impressive technology, who are paving the future in financial services and capital markets! Applications are still open, so apply now before the March 17 deadline. At the event, you’ll get a first look at groundbreaking technology, innovative platforms, and the chance to network freely with top industry professionals. Over 550 FinTech CEOs, C-suite executives of financial institutions, VCs, press, and others attended the 2016 Benzinga Fintech Awards. 45 exclusive exhibitor spots on the show floor […]

Westpac’s Reinventure hires new partner to help fintech startups crack the US

Westpac’s $100 million venture capital fund Reinventure has hired a new partner with experience from Wall Street and Silicon Valley, seeking to help local fintech start-ups attack the world stage and catch the eye of potential US suitors. US-born Kara Frederick, a former Goldman Sachs executive, was a senior adviser at US-based boutique investment bank GrowthPoint Technology Partners and also founded middle-market advisory firm Tiger Financial Group. She joins Reinventure founders and managing partners Simon Cant and Danny Gilligan as the firm’s first general partner. The fund was set up by the giant bank in 2014 to invest in fintech start-ups that could potentially compete with its own businesses. “Australia […]

SETL wants to settle and clear equities in competition with ASX

The ASX is facing competition for clearing and settling equities, with blockchain start-up SETL pledging to build a post-trading system cheaper and to deploy it quicker than the replacement for the existing CHESS infrastructure, which is being developed by the ASX itself and US group Digital Asset Holdings. London-based SETL is raising capital from some Australian brokers and has retained local lawyers to prepare regulatory applications to approve its system. The move comes as the federal government considers whether to remove the ASX’s monopoly over equities settlement and clearing – the vital “pipes” that underpin the operation of Australia’s equity markets – later this year, if regulators can devise a […]

Super fund Spaceship accused of high risk and not enough returns

A start-up super fund that is aggressively targeting millennials via social media has investment advisers alarmed that it is more expensive than most super funds and is taking significant risk without promising higher returns. But Spaceship, which has the backing of venture capital and tech luminaries such as Atlassian co-founder Mike Cannon-Brookes, says strict rules mean it can’t gamble customers’ super, while the fees are a small price to pay for the superior returns that will come from investing in technology. The super fund says it expects to kick off with $100 million of funds under management from young Australians when it launches later this month, after “early adopters” moved […]