Finspo partners with AFG to help Australians save

The appointment of AFG comes as Finspo prepares to launch its free, easy-to-use service that will help Australians save on their banking.

Open banking ‘a pivotal event’ for mortgage industry: NextGen.Net

NextGen.Net and fintech Frollo have released a new report outlining how the regime can revolutionise the lending and mortgage industry in Australia.

Fintech flips mortgage industry on its head with digital home loan platform

Australian fintech Verteva has rebranded to Nano and written its very first home loan via mobile, as it prepares to disrupt the mortgage industry.

New survey reveals mixed broker sentiment on government initiatives

A survey of mortgage brokers from HashChing has revealed the state of mortgage broker sentiment on a number of recent government announcements.

Uno pilots new broker referral model

Online mortgage platform uno are trialling a new model that sees customers who sign up to uno being connected and referred to nMB brokers.

Mortgage broker fintech Effi forms Mortgage Broker Tech Council

Mortgage broker fintech firm Effi has today announced the development of its new Mortgage Broker Tech Council.

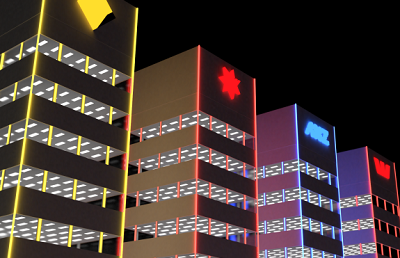

A comparison of how Australia’s Big Four Banks lend money

Finty’s Managing Director Andrew Boyd provides a comprehensive comparison of how Australia’s Big Four Banks lend money.

Lendi recognised as one of Australia’s most innovative companies

Australia’s leading home loan platform Lendi has been recognised as one of Australia’s best innovators in the AFR BOSS Most Innovative Companies List 2020.