AOFM approves investment into Prospa warehouse trust

The Australian Office of Financial Management has approved a maximum investment of $90 million into a Prospa Group Limited warehouse trust.

Prospa reports strong Q3 but Q4 hard hit by COVID

SME lender Prospa has reported “solid” performance in the March quarter, but revealed it was “materially impacted” by COVID-19.

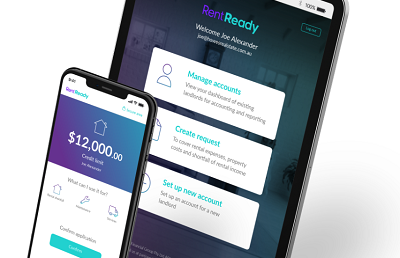

RentReady launches the first pay later solution in Australia for landlords

ASX-listed MoneyMe announce the launch of RentReady, a first to market pay later solution to help agents and landlords better manage investment properties.

Australian FinTech company profile #89 – Jacaranda Finance

Jacaranda Finance use risk based pricing to offer consumers a digital first personal loan product that is one of the fastest services in the country.

Q2 Cloud Lending helps GetCapital accelerate loans to Small and Medium Enterprises affected by Coronavirus

The Q2 Cloud Lending solution is focused on streamlining and digitising the loan process and can be set up and running within a week.

Mortgage fintech Funding.com.au raises $5 million warehouse to bring alternatives to cautious investors

Funding.com.au has raised a $5m warehouse from Equity Venture Partners to bring its secured lending platform to cautious investors seeking higher returns.

Neobank delays loan rollout due to COVID-19

Due to the COVID-19 pandemic, Volt Bank is delaying the launch of its loan products to ensure its foray into lending is done “in a very prudent way”.

SME stimulus not the answer, says lender

An SME lender has claimed that it is cash flow, not further stimulus, which is the key to economic recovery for Australia’s small businesses.