A fireside chat with Evan Wong, CEO of Australia’s leading Regtech – Checkbox.ai

Evan Wong is CEO and Co-founder of Checkbox. At only 25 he already has two successful startups under his belt. Checkbox is a Regtech solution that enables business people to build software without any sort of coding. Checkbox is to business applications what WordPress is to Web Design. Used by lawyers, accountants and bankers Checkbox is considered the ideal tool to fix the Regulatory and Compliance issues facing many financial institutions. How did you become an Entrepreneur? Evan: I founded my first business when I was 17, an education business called Hero Education. Until that point I’d never shown any signs that I was going to be an entrepreneur. Looking […]

Brisbane entrepreneurs make buying bitcoin easy

Digital Surge has removed all of the complications of other exchanges, making the purchase and trade of Bitcoin as simple as internet banking.

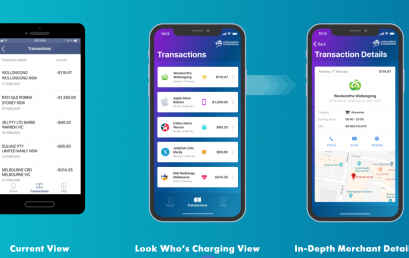

Local FinTech Look Who’s Charging eyes offshore expansion

Local FinTech start-up Look Who’s Charging has been selected as one of only 24 companies from around the globe to present their business on the centre stage at Money 2020 in Las Vegas this coming October. Look Who’s Charging is a Data as a Service business and one of the first companies globally to solve the problem of unrecognisable transactions. Look Who’s Charging links the often-random narratives from debit and credit card transactions to in-depth merchant details. NAB integrated Look Who’s Charging into their digital applications earlier this year. In the past 12 months Look Who’s Charging has helped to de-mystify over 15 million transactions many of which would have […]

FinClear captures 50% of market with Dion acquisition

FinClear, the Australian clearing, settlement and wealth management technology and service provider, has captured approx. 50% of the Australian retail clearing and settlement market with a transformational acquisition of the Australian assets of financial technology company Dion Global. Managing Director David Ferrall said the acquisition, which will complete in September, would support the firm’s rapid growth and provide efficiencies of scale. “We’ve seen a tremendous response locally since we launched last year – we have grown our stockbroking client base from zero to 20 clients in less than 12 months and doubled our resources with teams in Sydney, Melbourne, Queensland and now Perth,” he said. “Because we manage the entire […]

Advice Intelligence launches new world financial planning technology

Advice Intelligence (a.i.) has launched Version 1.0 of it’s software platform to financial advisers across Australia.

Successfully testing a new e-Invoicing approach with Small Business and Government

Link4 recently took part in an e-Invoicing pilot to test and demonstrate how small and medium businesses could instantly send their invoices to the NSW Government through e-Invoicing. The pilot was conducted with the NSW Department of Finance, Services and Innovation which partnered with one of its suppliers, TeleResult, to test e-Invoicing as a solution for streamlining the receiving of invoices. Brian Stevens, Practice Director, TeleResult enjoyed being able to instantly invoice the Department during the pilot and could see the value of implementing this invoicing system with other clients. “This could take all of the questions regarding invoice delivery and invoice processing status away,” said Mr Stevens after the […]

One in two employees want financial wellbeing assistance from employers

One in two (58%) employees state they want their employers to provide financial wellbeing tools, but only 14 percent of employers currently provide them, according to Map My Plan, a fintech firm which improves the financial fitness of Australians. In its Financial Stress in the Australian Workplace (the Insight Paper), released today, Map My Plan revealed 68 percent of managers believe financial wellbeing of their staff is ‘absolutely vital or important’ but 60 percent have no financial program. Paul Feeney, Founder of Map My Plan said, “We’ve found one in two employees are likely to be financially stressed, and it’s impacting their productivity, engagement, sleep, and even their mental and […]

Pull together for the Aussie Drought Row-lief

The entire state of NSW has been declared in drought after a drier than ever June and July. As a result, the state’s farmers are experiencing one of the toughest winters they have seen. With failing crops, water shortages and a diminishing supply of fodder to sustain stock, farmers are struggling just to keep their stock alive, let alone make ends meet. Companies nationwide have been doing their part to help out, donating money to help the families living on the land with necessities, or donating hay bails to help keep their herds alive. As a small business with a big heart, Brisbane-based lender, Jacaranda Finance has decided to jump […]