CoinJar exchange lists Zcash (ZEC) offering world first ZEC/AUD order book

CoinJar has expanded its offering by listing Zcash (ZEC) in its portfolio, meaning that for the first time in Australia, cryptocurrency traders and investors will have access to a ZEC/AUD trading pair using an order-book through CoinJar Exchange. Zcash (ZEC) is a leading privacy coin and will be listed alongside Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP). Traders and investors can hedge their ZEC holdings against major fiat pairings including Australian Dollars (AUD), Great British Pounds (GBP), Euros (EUR) and US Dollars (USD) to temporarily protect their portfolio from price fluctuations. CoinJar customers will now be able to send and receive Zcash with their CoinJar wallet, pay bills […]

“It takes an army”: Co-founder of pocket money app Spriggy Alex Badran on growth, getting some perspective, and securing backing from Mike Cannon-Brookes

Pocket money app startup Spriggy has seen a 380% increase in its customer base, quadrupled its headcount, and secured funding from Atlassian co-founder and Australian startup legend Mike Cannon-Brookes — and that’s all in the past 12 months. Founded in 2015 by Alex Badran and Mario Hasanakos with an initial $300,000 investment, Spriggy provides a mobile app that allows parents to give their children pocket money digitally, by loading cash onto a prepaid card for the children to use. The app also allows kids to monitor their spending, in a bid to teach them good money management skills. The startup was named as an emerging fintech star in the KPMG Fintech […]

Understanding Australia’s fintech ecosystem

Bankers today know that most fintech companies aren’t out there to take away a share of the market. Instead, their raison d’être is to create disruptive solutions that banks can leverage in order to deliver on customer expectations and improve customer experiences. In Australia, the fintech ecosystem has been burgeoning for a few years now, and Sydney and Melbourne have emerged as the two hubs that fintech companies embrace. According to a KPMG study, jointly Sydney and Melbourne account for 75 percent of all VC investment nationally. Further, the study found that the state of New South Wales leads the way in terms of fintech companies with 61 percent of […]

Top reward credit cards for Apple, Samsung, Google, Fitbit, Garmin Pay

Whether you’re an Apple or Android smartphone user or prefer Apple, Fitbit or Garmin smartwatches, chances are you already have access to Apple Pay, Samsung Pay, Google Pay, Fitbit Pay and/or Garmin Pay – all of which can be your ticket to earning valuable frequent flyer points with just one tap. For example, you might have an iPhone – compatible with Apple Pay – and can use that to pay for purchases in-store and online using your points-earning credit card. At the same time, a Fitbit Ionic or Versa smartwatch – both of which work with Fitbit Pay – might come in handy for making small purchases after your workout, […]

Max ID launches Australian-first digital technology that provides ‘safe harbour’ identity verification for property transactions in less than 10 minutes.

Max ID, an Australian Fintech facilitator and RegTech specialist, has today publicly launched a technology solution that it believes will bring a broad range of industry players a step closer to their aim of delivering simple, efficient and inexpensive same-day ‘safe harbour’ identity verification for mortgages and property services transactions. Financial institutions and non-bank mortgage lenders have long been endeavouring to provide intra-day, unconditional home loan approvals. There are a number of hurdles to achieving that outcome in Australia, including the requirement to conduct a face-to-face and in-person interview with the borrower to meet regulatory requirements. Until now that requirement has created a conflict between delivering regulatory ‘safe harbour’ outcomes, […]

ASX pushes back the start date for its blockchain

ASX has pushed back the “go live” date for its blockchain to clear and settle the Australian equities market by around six months, after market participants expressed concerns about meeting an ambitious timeline given the complexity of the technological change. Market players used a consultation process to express “a strong interest in better understanding the potential benefits that a DLT [distributed ledger technology]-based system can offer”, ASX said in a new “scope and implementation plan” for its replacement of the CHESS system. Brokers and investors want as much time as possible to get their heads around the technology, and to determine what investment spending will be required to connect with […]

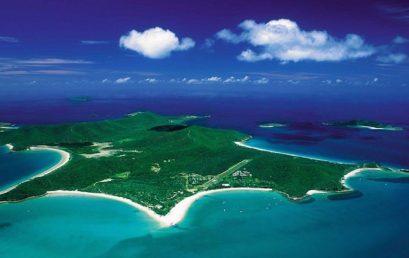

Cryptocurrency behind Great Keppel Island’s $300 million resurrection

There was a time when Great Keppel Island was sold as the ideal place to go and “get wrecked”, a party island at the gateway to the Great Barrier Reef. It then faded into disrepair and then into memory. Now an ambitious cryptocurrency consortium plans to resurrect it as a high-tech wonderland including a luxury resort, private villas and apartments, a golf course, retail outlets and a marina in what is being sold as the world’s largest cryptocurrency-backed property deal. If all goes to plan, they boast, when the development is complete Great Keppel will become the world’s largest island cryptocurrency micro-economy, a project that could bring the new digital […]

Australia to trial a SWIFT-er cross-border payments service

SWIFT, the organization providing messaging and standards frameworks to financial institutions, will start trialing its new real-time cross-border payments service in the Asia Pacific region, initially focusing on inbound payments to Australia. With the new instant global payments innovation (gpi) service, banks can improve customer experience by providing faster P2P remittances and SME trade settlement. The trial will initially include banks from Australia, China, Singapore, and Thailand, using the New Payments Platform (NPP). NPP is Australia’s new real-time payments system which went live earlier this year. Although the trial is currently being run on NPP, the service is designed to scale and integrate with real-time systems around the region. According […]