Almost two million Aussies use Buy Now Pay Later

The Worldpay 2020 Global Payments Report from FIS has revealed that nearly two million Australians used a Buy Now Pay Later (BNPL) product in 2019.

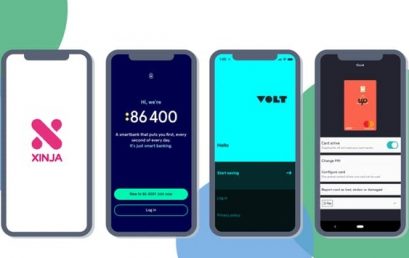

Young savers flock to new wave of neobanks

Young savers are clambering aboard a new wave of Australian digital banks such as Up, Volt, Xinja and 86 400 in recent times.

Platform provider pushes blockchain approach for fee consents

Iress has called for an industry standardised approach based on blockchain, responding to new legislation governing ongoing fee arrangements.

Australian FinTech company profile #78 – Auxilis

Auxilis build technology that takes complex and often hard to access information in various forms and then transform and present it in a more usable form.

Omni-Financial launches first phase online home loan application

Melbourne fintech Omni-Financial has today launched the first phase of its complete online home loan application, with ME Bank providing the loans.

Wefund launches fast, transparent, and secure development finance platform

Wefund announce the launch of their unique, development finance platform, which gives property developers quicker access to multiple non-bank lenders.

Funding.com.au continues to add high profile players to its team

Following its $3.7m Series A capital raise, online mortgage marketplace funding.com.au continues to bolster its senior management with additional hires.

Join the Frollo Open Banking wait list

Frollo announce they’re opening their Open Banking wait list, where you can sign up to be one of the first people in Australia to use Open Banking.