The fintech transformation

According to one fintech expert, brokers could soon be replaced by smart speakers. But will customers embrace such a technological leap? Until the early 2000s, the process of booking a holiday involved trips to multiple travel agencies, hours thumbing through glossy brochures, and more sit-down meetings than the average mortgage currently requires. Today it’s a task that can be completed on a mobile phone during a coffee break. There are many reasons why the travel industry experienced such a shift, from the lure of competitive prices to the convenience of consumers becoming their own armchair agents. People simply wanted to take more control. Seeing the same demands echo throughout the […]

Neo-lender Wisr announces record loan growth

Neo-lender Wisr more than doubled personal loan originations in the second-half of the financial year after a strong Q4, the company announced today. Loan origination value in H2FY18 rose by 136% on the previous six months, whilst the number of new Wisr customers climbed 118% during the same period. The result follows the company’s largest single quarter in loan growth – with a 66% increase in loan origination value and 40% in loan origination volume during Q4 compared to Q3FY18. It is the second successive quarter that Wisr has achieved record loan origination growth. According to the 2017 Asia Pacific Alternative Finance Industry Report by Cambridge University and Monash University, […]

Australia needs state-backed SME investment: ombudsman

The small business ombudsman has released a long-awaited report on SME access to capital, and issued a range of recommendations, including the establishment of government-backed SME investment fund. Releasing the Affordable Capital for SME Growth report, Kate Carnell, the Australian Small Business and Family Enterprise Ombudsman (ASBFEO), said that Australian lenders consider SME loans to be high-risk, which has unwanted flow-on effects. “In Australia, lenders consider SMEs high-risk and offer capital with restrictive terms and conditions, at high interest rates and demand bricks and mortar as security – which is usually the family home,” Ms Carnell said. “Unfortunately, the unintended consequences of the financial services royal commission for SMEs might […]

Non-banks are the future of banking

The future of banking is in the hands of non-banks, says specialist lender Liberty. Non-banks, by nature, are “active, nimble, innovative and relevant”, allowing them to lead the competition, rather than be threatened by big banks. Non-banks provide a variety of solutions such as home loans, car loans, personal loans and business loans, as well as custom lending for those that need it. But as the financial world welcomes more and more technology, and increased regulation drives up costs, it leaves many to wonder how non-banks will respond to these changes. Asked about how non-banks will adapt to the future, group sales manager at Liberty, John Mohnacheff, laughed: “How are […]

How the rich invest: Afterpay’s Nicholas Molnar makes a cool $200 million

The tearaway market success of Afterpay Touch Group has however supercharged the fortunes of its 28-year-old co-founder Nicholas Molnar. Afterpay is fast becoming the go-to payments platform for Millennial shoppers who want to own products immediately but pay for them in instalments. The instalment service is growing rapidly. It has more than 1.8 million customers and is growing at roughly 3300 new customers per day. There are now 14,000 retailers using the service; it will soon be available for buying Jetstar flights and in May announced it was transacting in the US after cutting a deal with retail powerhouse Urban Outfitters. The potential for growth in the US has been […]

Supply Chain Finance: What’s It All About?

Picture this. You run a business. It’s successful. You’re a supplier (subcontractor, etc.) to a large company (major retailer, major contractor, think big and corporate). You get an invitation to join their supply chain finance program. But what does that mean for you? And why is it being offered in the first place? It’s possible this is the first time you’ve ever heard of supply chain finance, and if it is you wouldn’t be alone. It’s also referred to as supplier finance, or as an early payments program, and essentially, it’s a financing program by a large corporation that lets the businesses it deals with in it’s supply chain access […]

Fintech Startup Trade Ledger expands UK operation. Appoints New CFO

Fintech startup Trade Ledger — which describes itself as the world’s first corporate open banking lending platform — has announced the opening of its European operation, headquartered in London, along with additional hires. Lisa Callaghan will move from the role of accountant to Chief Financial Officer at Trade Ledger’s Sydney office, after representing technology start-ups from inception through to early fundraising as a partner at Interactive Accounting. The UK operations will be headed up by a new Chief Innovation Officer with the company tapping some talent from Equifax UK. The expansion is designed to boost Trade Ledger’s international traction and product market fit, and should allow it to take advantage […]

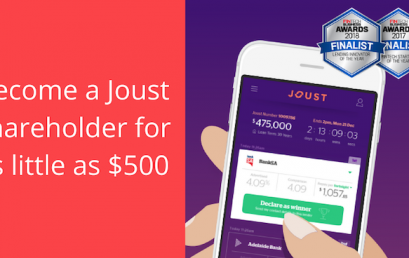

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]