ScotPac backs calls for big business to accelerate SME payment times

ScotPac has backed calls by Bruce Billson for big businesses to ‘lift their game’ on ‘woeful’ payment times to SMEs.

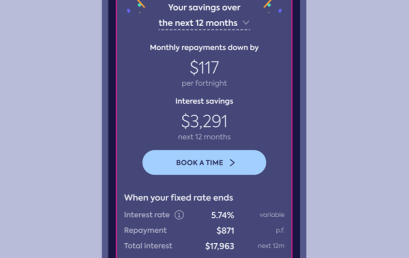

Digital mortgage broker Finspo launch game-changing calculator to help those with fixed rate loans coming to an end

Fixed rate mortgages are coming to an end in record numbers, in fact 46% of all fixed rate loans are expected to expire in 2023.

Mambu and EY identify five crucial success factors to champion underserved SME segment

EY and Mambu have identified five crucial success elements that financial institutions need to consider to ensure their lending offerings are accessible to SMEs.

Wisr delivers maiden profitable quarter

Wisr’s strong cost control and other strategic decisions made by the team have delivered a material Cash EBDTA profit and strong positive operating cash flow quarter.

Funding.com.au launches market first bridging loan quote technology

Funding.com.au has launched its new instant quote tool, which allows customers to get an instant quote for a loan with the digital bridging lender in real time.

CitoPlus integrates first lender to commercial broker platform

CitoPlus platform can now receive an indicative approval and submit a line of credit deal directly to TP24.

Westpac and Rich Data Co partner to improve the lending experience

Wesptac and Rich Data Co will enable predictive data features to improve the lending experience and better support Westpac customers.

ASX-listed fintech Plenti continues to deliver profitable growth

Australian fintech Plenti has continued on delivering profitable growth for yet another trading quarter.