Nearly 1 in 3 Australians experienced drop in income due to pandemic and many will switch banks: FICO

Many Australians are motivated to search for better banking offers, and that the inclination to switch banks has increased year over year.

Funding.com.au launches first Broker portal

Funding.com.au’s new Broker portal features include live Broker chat support, deal lodgement, live deal tracking, Brokers Lending portfolio and much more.

Plenti partners with online vehicle retailers Carma and The Good Car Company

Plenti has partnered with Carma and The Good Car Company, to provide financing to customers buying vehicles through their platforms.

Bendigo and Adelaide Bank team up with Sandstone Technology to transform the Third-Party lending channel

Bendigo and Adelaide Bank partnered with Sandstone Technology to transform and streamline their loan processing systems and processes.

Grow Finance launches new Low Doc No Deposit Asset Finance product

Non-bank business lender Grow Finance today announces the launch of its new Low Doc No Deposit Asset Finance product for Tier 1 assets.

Nano announces major B2B expansion plan to bring fast, digital mortgages to all

Nano launches Nano Lending Solutions business, set to power lenders across Australia, and around the globe in a major B2B expansion drive.

Australian fintech Cloudcase Software Solutions helps Gateway Bank grow home loans

Gateway Bank, in partnership with Australian fintech Cloudcase Software Solutions, helped it streamline and automate its loan originations.

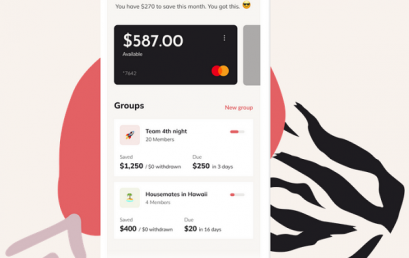

New banking app Chippit launches in beta in Australia

New digital banking app Chippit has launched in Australia in a closed beta, access for which is currently waitlisted.