100 million reasons to use non-bank disruptor TechLend

Just two months since launching non-bank lender TechLend has already reached $100 million in bridging loan applications.

Lending is surging – But what does it all mean?

A comprehensive insight into lending indicators by Savvy late last August showed that housing lending is booming.

OnDeck gives small businesses a break to take back their time

OnDeck Australia is supporting the cashflow needs of the nation’s small businesses by offering a 4-week repayment holiday to new and renewal loans.

Bluestone Home Loans’ brokers reap digital revamp rewards

Bluestone Home Loans has introduced NextGen.Net’s ApplyOnline Application Centre as a key integration in their newly overhauled digital lending platform.

ScotPac and Trade Ledger partnership supercharges business funding

ScotPac and Trade Ledger have joined forces to create a market-leading origination and underwriting experience for business funding.

Lendi sharpens its home loan process with Google Cloud

Australian fintech Lendi is using Google Cloud capabilities to automate its mortgage origination process as it works towards a same day approval for a loan.

Australian FinTech company profile #138 – Banjo Loans

Banjo Loans provides working capital solutions to small and medium sized enterprises.

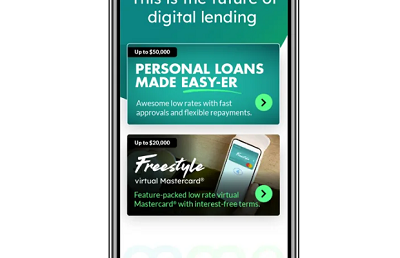

MoneyMe reports record growth and returns

ASX-listed MoneyMe Limited announces its financial results to 30 June 2021, with record growth and returns.