Biometric technologies championing a risk-free future for banks and mortgage lenders – COBA 2022

The new wave of digital verification software, built on biometric technologies promises to mitigate risks for banks and mortgage lenders.

Avenue Bank partners with nCino to reimagine SME Business Banking

Cloud banking pioneer nCino has announced that digital business bank Avenue Bank is live on the nCino Bank Operating System.

How data is the key to unlocking innovation within Australian financial services

‘The top data and technology challenges in financial services across Asia Pacific’ survey found that data silos were creating huge data challenges.

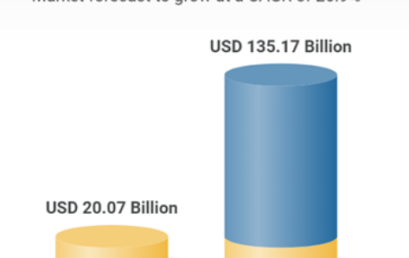

The Open Banking industry is expected to reach $135 Billion worldwide by 2030

The global open banking industry size is expected to reach US$135.17 billion by 2030, growing at a CAGR of 26.9% from 2022 to 2030.

CommBank becomes first major Australian bank to enable PayTo payments for CBA customers

The Commonwealth Bank has become the first major Australian bank to enable PayTo payments for CBA customers.

Banking-as-a-Service will hit mainstream adoption within two years: Gartner

Banking-as-a-Service will hit mainstream adoption within two years, according to the latest Gartner Hype Cycle for Digital Banking Transformation.

Leading CDR solutions provider Adatree launches Open X Use Case Report

Adatree has launched a use case report for Open X – providing a whole range of new cross-industry Consumer Data Right (CDR) use cases.

How your data can create business opportunities in banking

Data has quickly become one of the most valuable resources when it comes to successful business expansion.