How your organisation can drive better customer experiences with data democratisation

An InterSystems survey shows that 24% of Australian banking leaders are not confident that their organisation has a 360-degree view of their customers.

Is customer experience tech challenging the status quo in banking and finance?

Customer experience is the cornerstone of an effective, developing business, and this is nowhere more apparent than in the banking and finance industry.

How to access Open Banking now – become a CDR representative

Under the CDR representative model, businesses can gain access to open banking data while waiting to become fully accredited.

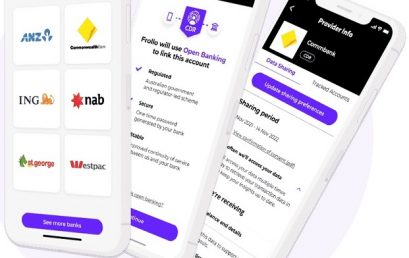

Australia’s most popular money management app phases out screen scraping in favour of Open Banking

Frollo has already disabled screen scraping for ANZ, CommBank, NAB and Westpac and is planning to do the same for at least 50 other banks.

The rise and rise of term deposits

Now, with interest rates on the rise, term deposits are back on the radar, in a new digital incarnation – Sandstone Technology.

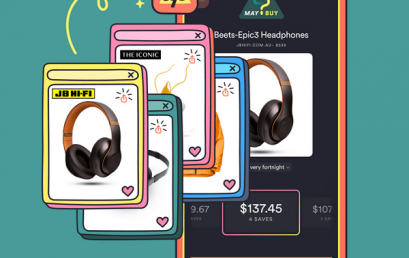

Up launches Maybuy, a savings-based solution to Buy Now Pay Later

Introducing Maybuy – a feature encouraging customers to celebrate the joy of their purchases safely, protecting from fees and buyer’s remorse.

Sandstone Technology positioned as the leader in the 2022 SPARK Matrix™ for Digital Banking Platforms by Quadrant Knowledge Solutions

Quadrant Knowledge Solutions has named Sandstone Technology a 2022 technology leader in the analysis of global SPARK Matrix™: Digital Banking Platforms market, 2022.

Why customer-owned banks must embrace next-gen banking technology to remain competitive

More consumers are beginning to look at customer-owned banks to understand if these smaller, more personal banks can meet their needs.