Banking-as-a-Service will hit mainstream adoption within two years: Gartner

Banking-as-a-Service (BaaS) will hit mainstream adoption within two years, according to the latest Gartner Hype Cycle for Digital Banking Transformation. Gartner predicts that 30% of banks with greater than $1 billion in assets will launch BaaS for new revenue by the end of 2024, but half will not meet targeted revenue expectations.

Speaking at Gartner IT Symposium/Xpo 2022 on the Gold Coast today, Jeff Casey, senior director analyst at Gartner said, “These banks typically have ambitions to generate and diversify revenue streams, or to a lesser degree, aspire to extend previously sunk regulatory investments, such as PSD2 in Europe, into revenue-generating machines.”

BaaS is one of four technologies that Gartner says have potential for high levels of transformation in the banking sector and are likely to mature within the next couple of years. The other technologies include chatbots, public cloud for banking and social messaging payments apps. Bank CIOs should consider how key innovations are shaping their industry and prioritise their technology investment strategies accordingly.

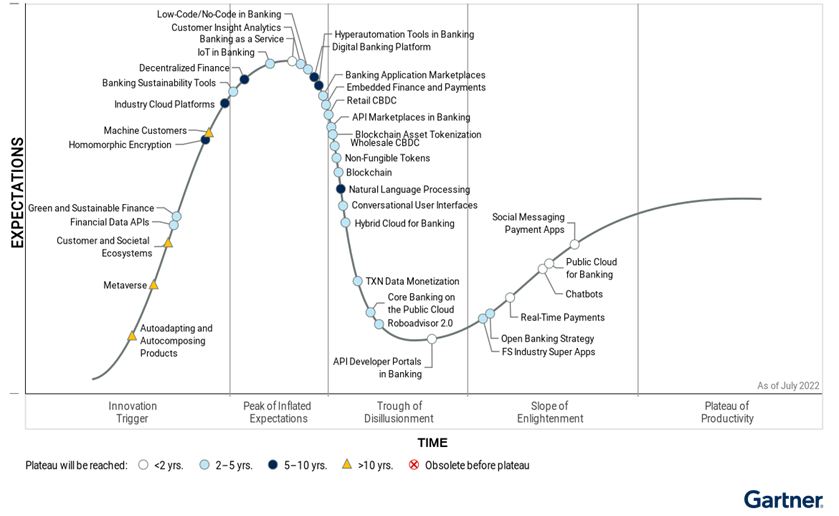

BaaS sits at the peak of the Hype Cycle (see Figure 1). The technology is gaining traction from both banks and nonbanks aspiring to establish or enhance direct and intermediated revenue streams.

Source: Gartner (September 2022)

“Technology innovations like these are driving bank and nonbank competitor activity, influencing customer demand for product and services, and shaping regulators’ actions globally,” Casey said.

BaaS

BaaS can be a discrete or broad set of financial service functions exposed by chartered banks or regulated entities to power new business models deployed by other banking market participants — fintechs, neobanks, traditional banks and other third parties.

Market participants are increasingly drawn to collaborative models that enable enhanced customer experiences, such as richer features, a broader set of products and innovative customer experiences. Nonbank participants benefit from a quick onramp to the banking market by leveraging a regulated entity’s license instead of pursuing their own charter.

Chatbots

Chatbots represent one of the primary use cases of artificial intelligence (AI) in banks and will impact all areas with communication between machines and humans. While mostly applied to customer service, IT service management or human resources, chatbot uses are incredibly diverse. The change from “the user learns the interface” to “the chatbot learns what the user wants” has implications for onboarding, training, productivity and efficiency inside the workplace.

The sophistication of the enterprise conversational AI platform market has led to enhanced tooling for banks to build and maintain chatbots using non-IT resources. Operationalisation in the business units outside of IT is making chatbot production a more productive activity.

Public Cloud for Banking

Public cloud adoption is becoming highly transformational to the banking industry since banks can achieve a greater level of efficiency and agility by moving workloads to the cloud. Public cloud for banking delivers banking-specific software within a public cloud ecosystem, by integrating those applications with different degrees, from cloud-based to fully native.

Banks achieve agility by rapidly scaling up and down to support changes in demand, as well as meet regulatory compliance by delivering on temporary demands. Resources are freed up for the development of digital assets by centralising and optimising them; fixed costs are reduced by avoiding oversized infrastructures; and cost structures are optimised. Banks are also able to centralise applications and platforms that ease development and testing, avoiding overlapping or duplications.

Social Messaging Payment Apps

Social messaging payment apps rely on instant messaging platforms to originate payment transactions. The messaging app interface is used to register payment accounts and to initiate and monitor related transactional activity. The modernisation of payment infrastructure and the ability to make use of open banking and payment APIs, provided new entry avenues for social messaging apps to deliver payments service.

The adoption of social messaging apps has transformed both shopping and payment behaviour, notably in Asia. Kakao Pay, LINE Pay, WeChat Pay and WhatsApp Pay all demonstrate how social messaging apps provide both the contextual data and interface to engage with customers.