Fintech funds are drying up, but some local players welcome the drought

Aris Allegos, the founder of online small business lender Moula, was an entrepreneur in the dotcom era and an investment banker during the global financial crisis, so he has seen first hand the havoc a speculative frenzy can create. But as the torrent of capital from US funds backing start-ups in the burgeoning fintech industry slows, instead of panicking, this time around Allegos and his rivals are more relaxed. Although less capital will mean not all start-ups will survive, a more rational approach by investors will ensure money isn’t wasted, local fintech players say. “Before the [dotcom bust] an IPO document would say ‘This business gets X number of eyeballs’ […]

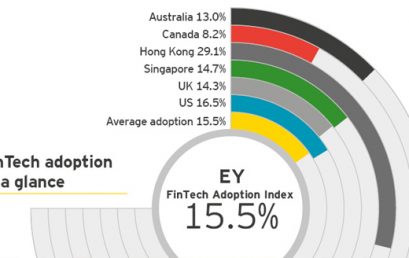

‘EY Fintech Adoption Index’ – out today

Ernst & Young have now released their ‘EY Fintech Adoption Index’ which outlines how quickly the market is taking up FinTech products. While we are a market leader in the adoption of credit card contactless payment technologies we are slow to take up FinTech products. As our market matures this is sure to change. Exploring a new financial services landscape Driven by innovative startups and major technology players, the booming FinTech industry is capturing traditional market share by offering customers easy-to-use and compelling products and services. We surveyed more than 10,000 digitally active people in Australia, Canada, Hong Kong, Singapore, the United Kingdom and the United States to better understand […]

Rise in data theft opens door for fintech

The ability to protect sensitive client information will be an integral driver for fintech companies, argues Midwinter managing director Julian Plummer. In a statement, the head of the financial planning software provider said companies that can secure high volumes of confidential data will become particularly important to the financial services industry in the coming years. “Ensuring the safety of all sensitive client data for our advisory clients has become a top priority for Midwinter, and we have taken extreme actions to ensure that information is managed and stored securely, so as to continue Midwinter’s clean slate of zero security breaches.” Zirilio executive managing director Tom Dole said he has seen […]

CBA eyes collaboration with fintech companies in Asia and Europe

Kelly Bayer Rosmarin, CBA’s (CBA) Group Executive, Institutional Banking and Markets, said the Hong Kong and London labs highlighted the banks’ global approach to innovation that connected customers, employees and start-up communities to the latest fintech developments. “Hong Kong’s highly developed financial sector, strong entrepreneurial culture and proximity to China makes it the optimal location for us to establish an innovation presence in Asia,” she said in a statement. “The Hong Kong Lab will allow us to partner with the brightest minds across the city’s accelerator, government, university, start-up and fintech communities to further develop creative and innovative solutions for our clients.” Speaking in Hong Kong at the opening ceremony […]

The Australian FinTech Ecosystem’s Growth is Breathtaking

Here’s a great article and infographic that has been written by Lets talk Payments. It is always nice to get an outsiders view of a market, especially when it’s as positive as this one. Continuing our world FinTech haul after looking at London, New York, Hong Kong, Singapore and other international FinTech hubs, we decided to take a closer look at the Australian FinTech ecosystem. Recently, Aussie banks and investors have demonstrated a passionate interest in exploring opportunities with FinTech, which worth taking into consideration if you are looking for international expansion. Source: The Australian FinTech Ecosystem’s Growth is Breathtaking | Let’s Talk Payments

Ken Henry says NAB has strong capital and is ready to embrace fintech future

“If digital innovation leads to more efficient ways of achieving credit intermediation, we are in a strong position to embrace those new efficiencies. Maybe the whole sector becomes more efficient. If it does, our customers will benefit. “The establishment of NAB Labs, an innovation lab in Melbourne, and NAB Ventures, a corporate investment fund to invest in start-ups, aims to imbed an innovation culture across the bank, Dr Henry said, while also providing access to cutting edge ideas where they are emerging globally. “We are not sitting on hands here. We see [fintech] as both interesting, and an opportunity for us to do what we currently do better and for […]

Innovation – NSW innovation minister says he will deliver three things the startup community is pleading for

He says one of the flagship policies of the state government last year was the establishment of a “world first” government data analytics centre facilitating data sharing between government agencies and allowing for the analysis of the effectiveness of policies. Dominello says the better use of public data can also assist with one of the booming startup sectors in the state: fintech. With Stone & Chalk and the Tyro co-working space, Sydney is leading the way with fintech startups, and Dominello wants it to stay that way. “We’re already the centre in south-easy Asia for banking and finance, so the fintech sector in particular is very, very strong,” he says. […]

New fintech platform to ‘take business from brokers’

A former major bank executive will launch a new fintech business this year to compete directly with the third-party channel on prime mortgages. Mark Bevan, who spent 25 years at CBA and six with Westpac, is the co-founder of Joust, an online platform that allows lenders to compete for home loan deals through a live digital auction process. The platform involves a panel of lenders bidding (or jousting) to be the provider of a customer’s home loan. The Adelaide-based fintech business aims to target prime mortgage customers with good credit ratings, good jobs and equity in their homes. Source: New fintech platform to ‘take business from brokers’ – Mortgage Business