uno cracks the formula for 10-minute home loan recommendations

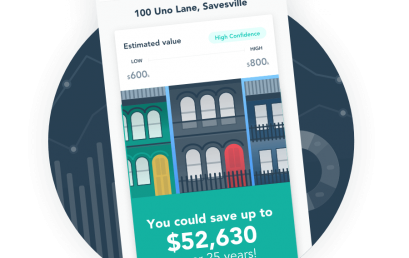

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here. The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders. This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving. uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they […]

Backing local talent to build the Australian FinTech sector

New scholarship announced to grow future FinTech leaders FinTech may be the talk of the town, but it’s nothing if it doesn’t move forward. To ensure the industry keeps innovating, and to give back to the country supporting their battle against the ‘big dogs’ of the FinTech world, Nifty Personal Loans (Nifty) has launched a scholarship program. To pave the way for the business and finance leaders of tomorrow, Nifty has announced that they will be giving one Bachelor or Masters Business, Finance or IT student a helping hand in the form of a $2500 lump sum each semester which can be used for university fees, resources and technology, research materials […]

Will property crowdfunding take off in Australia?

Investors who feel bewildered by the ever-changing regulations on bank loans and costly mortgages should consider entering the Australian property market through crowdfunding. A new study conducted by the University of South Australia (UniSA) in partnership with DomaCom, suggests that crowdfunding could become a viable new vehicle for investors trying to make headway into the country’s increasingly challenging property market. Braam Lowies, the study’s lead researcher, noted that while the concept was relatively new in Australia, it had been successful in the United States and United Kingdom for approximately seven years. Young investors should consider crowdfunding A survey conducted as part of the study showed that crowdfunding attracted a mix […]

What online finance can give you that the Big Four can’t

With dissatisfaction among the big banks continuing to rise, more Australian SMEs are attempting to figure out how they can use alternative lenders to grow their businesses. But that’s easier said than done. With so many alternative lenders arriving in Australia, it can be difficult for SMEs to figure out which is going to best suit their needs for unsecured business loans. How can they start? According to the recent SmartCompany SME survey, which questioned hundreds of SMEs around Australia, 25% of readers said they wanted to get a business loan in two years. Of those, 51% said they would approach one of the big four banks, and 31% would […]

The other credit risk to watch in China: Fintech-fuelled debt

China’s government has copped what Scott Morrison is so desperate to avoid: a credit rating downgrade. But in the discussion about Moody’s surprise move last week to cut its rating for our biggest trading partner, there’s one word that has been notably absent, even though it’s a risk of growing importance to investors and officials. That word is “fintech”. Nowhere are the large potentially huge benefits of fintech – and longer-term risks – clearer than in China. This realisation comes as financial regulators everywhere, including in Australia, start to turn their attention to how these risks could eventuate, if fintech one day grabs a larger share of the financial services […]

OnDeck launches ‘Turn That No Around’ campaign

Small business loan specialist OnDeck Australia has kicked off a campaign, #turnthatNOaround, targeted at small business owners who are looking to seize growth opportunities, but are unable to do so due to lack of funding from traditional sources. The campaign, which is already running on radio, is scheduled to run across outdoor, social (LinkedIn and Facebook) and digital media to encapsulate an integrated multi-channel outreach. With the #turnthatNOaround campaign, OnDeck aims to reach small business owners who have experienced a “no” from their banks, giving them an opportunity to secure a loan that is much faster than the banks – it takes just one business day. “Small business owners, which […]

Peer to peer economy now worth over $15 billion a year

Higher levels of consumer trust in the sharing economy, have coincided with a $600 million increase in size over the past six months, according to a newly released report. The bi-annual Sharing Economy Trust Index, produced by peer-to-peer lender RateSetter, showed that trust in ride sharing platforms such as Uber and online marketplaces like eBay have grown the most. “Our research found that trust levels in the sharing economy have increased substantially over the last six months,” said Daniel Foggo, RateSetter CEO. With the sharing economy now worth over $15 billion a year, the study revealed that over two thirds of Australians actively participate in the market – whether by […]

Kate Carnell urges pressure on banks to change

Small business ombudsman Kate Carnell will today issue a strong warning to government that after 17 inquiries into the banking industry since the GFC the time has come to put pressure on the banks to change their practices. Carnell’s report on small business lending is due to be released today by Revenue and Financial Services Minister Kelly O’Dwyer and Small Business Minister Michael McCormack. It will say the banks have treated small business unfairly. The recommendations include blocking default action on loans under $5 million where the business has complied with the terms. It also wants a revised code of conduct from the banks written in plain English and with […]