Australian FinTech company profile #52 – Study Loans

Study Loans is the first dedicated provider of student loans in Australia, to bring new and innovative funding alternatives to student education funding.

Designing Voice AI for Home Loans: Humanistic conversations without the deception

Craggle’s voice AI listens like a human. It understands the intention behind the statement and can match it to the appropriate feature.

Banjo Loans reveals how SMEs can combat their business stress

Leading non-bank lender Banjo Loans is offering SMEs with loans some tools to help navigate the choppy waters they may be experiencing.

Navigating the Lending Landscape: A case study in loan origination optimisation

Navigating a competitive lending landscape, discover how Great Southern Bank and Sandstone Technology’s joined forces to elevate customer experiences through innovative loan origination solutions.

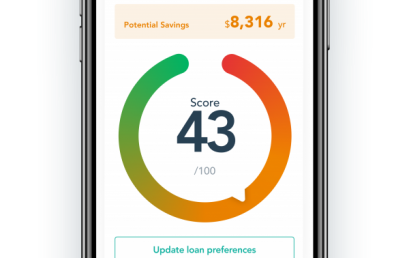

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

Demand for embedded finance soars among SMBs as traditional banks fall short: Airwallex

Airwallex, a leading global payments platform, announced a new global survey that revealed surging demand for cloud-based financial services.

Small businesses anticipate growth, despite tough conditions

Prospa research shows the majority of Aussie small business owners rate the health of their business as good and are anticipating growth this year.

Aged care sector turns to financial wellbeing tools to attract staff: Wagestream

Financial wellbeing fintech Wagestream, has signed with Southern Cross Care, Vacenti, and CareChoice in quick succession this month.