uno cracks the formula for 10-minute home loan recommendations

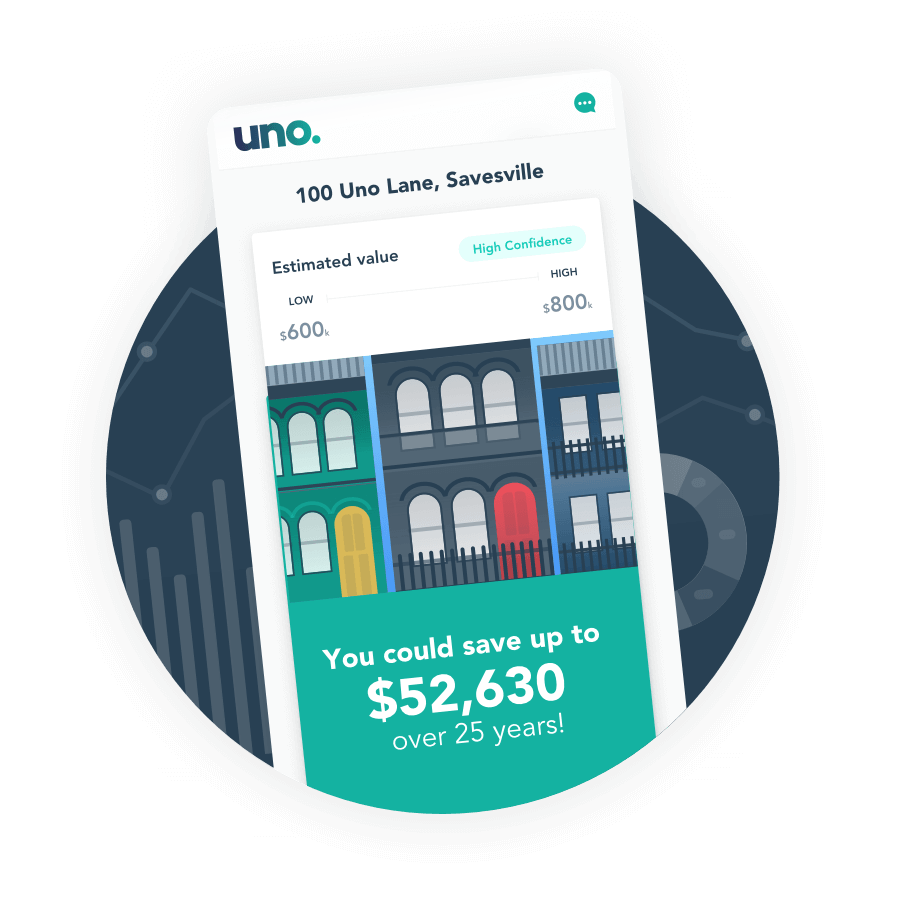

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here.

The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders.

This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving.

uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they can save a lot of money by refinancing but avoid going through the process because of the time and manual effort traditionally involved.”

“A recent study** found that 74% of Australian mortgage holders are turned off switching lenders because of the time involved and 77% view refinancing as a ‘hassle’.

“By automating the collection of a customer’s financial details, this digitised process alleviates a lot of the effort that prevents Australians from switching and saving.

“The new refinancing pathway instantly assesses credit policies from nine lenders to provide a recommendation of cheaper loans the customer is eligible for.

”With very little heavy lifting, mortgage holders know straight away how much they could save by refinancing.

“And borrowers are provided a higher degree of confidence around what they are likely to be approved for at the very start of the refinancing process – an increasingly important consideration with tightening lender credit policies.”

How it works

The new refinancing pathway reduces the recommendation process to 10 minutes by digitising a property valuation; verification of ID; credit checks; verification of income, expenses and liabilities; and assessment against lender credit policies.

Automatic property valuation

Upon the user entering the address of their property, uno provides an assessment of the property value using an automated valuation model (AVM) through CoreLogic.

Verification of identity

GreenID verifies the customer’s ID by checking their driver’s license or passport number against third party databases.

Verification of income, expenses, and liabilities

Users login to their online banking accounts using Proviso – a categorisation engine which uses industry-leading algorithms to check bank accounts for income, expenses and liabilities. Extraction takes seconds and data is encrypted with bank level 256-bit encryption, secured by 2048-bit keys.

Additional mortgages, credit cards, and other loans

Details of credit cards and additional loans are captured and factored into eligibility.

Credit check

Equifax runs a credit check to tailor loans to the user’s credit history. This does not affect the customer’s credit score.

Assessment

uno’s platform cross-references the collected customer financial data against inbuilt lender credit policies in order to recommend loans based on the customer’s personal scenario.

Recommendation

Customers receive a shortlist of loans they are eligible for and can review monthly repayments as well as estimated savings.

At this point, customers can choose to either receive a credit proposal which they can accept online or be directed to a home loan adviser who will provide a credit proposal.

Once a credit proposal is accepted, advisers review and submit the application to the selected lender. They then manage the process all the way through to settlement. Users can opt to speak to an adviser at any point during the process.

Who can use it?

The new refinance pathway is optimised for mortgage holders who want to refinance to a cheaper deal. Single or dual applicants can use the pathway.

Checking eligibility does not impact the customer’s credit score.

Currently, customers can choose from Bank of Sydney, CBA, CUA, HomeLoans Ltd, ING, Macquarie Bank, MAS, Pepper Money and Westpac loans.

To find out more about refinancing your home loan, please visit uno.

*Average saving for uno refinance customers who switched to a lower rate between January and May 2018. Savings calculated over life of loan, assuming consistent repayments.

**Survey of 1,500 mortgage holders by CoreData on behalf of uno