CUA launches Apple Pay on its EFTPOS rediCARD

Apple Pay is now available on the full range of CUA-issued debit and credit cards. Australia’s largest credit union CUA has today launched Apple Pay to its EFTPOS rediCARDs, allowing customers with the rediCARD to make real-time contactless purchases via their iPhone or Apple watch. The integration completes the loop for CUA, with Apple Pay now available on the full range of CUA-issued cards. The new functionality will enable CUA customers with rediCARD to make EFTPOS purchases via the digital wallet securely using their own money and in real-time. Customers with a compatible Apple device will now be able to choose to make the contactless payment with EFTPOS, by selecting […]

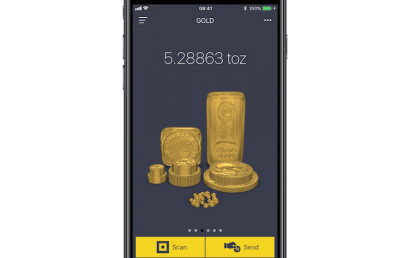

InfiniGold digital gold launches with The Perth Mint

In collaboration with The Perth Mint, InfiniGold has released the latest innovation in gold investment – a flexible digital gold product compatible with a wide range of technology platforms including blockchain. InfiniGold digital gold certificates offer institutions the opportunity to present investors with a new, secure and easy way to trade, hold and transfer physical gold. These digital certificates represent direct ownership of physical gold that is securely stored in The Perth Mint’s network of central bank grade vaults, which are located in the safe geopolitical environment of Western Australia. InfiniGold spokesman Sean McCawley said that InfiniGold certificates are the closest a customer can get to buying physical gold, in […]

5 Aussie fintech firms that are shaking up the home loan business

by Richard Whitten, finder.com.au The home loan industry is about to change in many ways with these Aussie startups leading the way. The home loan market is a multi-billion dollar industry that hasn’t yet seen many of the same disruptions as other industries. But that’s about to change. Fintech companies boasting apps, algorithms, blockchains and automated platforms are all promising to make the process of buying a house easier and faster.Here are five Aussie fintech companies who are poised to shake up the home loan market. Tic:Toc Tic:Toc launched earlier this year with a headline grabbing promise: the 22-minute home loan (application that is, not your repayments). This startup’s promise […]

Data revolution to transform four pillars model

You’re browsing through Facebook when a message pops up, asking if you’d like to check whether you’re getting a decent interest rate on your savings. Curious, you tap the screen to find out more. It asks you to provide a bit more information about your financial goals – you’re saving for a deposit on a house and hope to buy in about two years. You are then asked to give consent to securely share some key bits of financial information online: your income over the last six months, and your spending over this period. Within seconds, the app has a recommendation: it’s found a bank account and term deposit that […]

Tic:Toc selects MuleSoft to power instant online home loan service

MuleSoft, the leading platform for building application networks, today announced that financial services startup Tic:Toc has selected MuleSoft’s Anypoint Platform™ to power it’s real-time home loan approval system. Since conception in 2015, Tic:Toc has been working to create a fully automated online home loan application system. In July of this year, the Adelaide-based Fintech launched Tic:Toc and unveiled their new platform which they believe offers loan approval in just 22 minutes, compared with the industry average, which they claim takes 22 days. The service digitally evaluates a borrower’s suitability in real-time by calculating variables, such as property valuation, borrowing ability, credit checks and the validation of financial records. MuleSoft was […]

Banks want to charge for handing over customer data

Major banks want to charge fintech businesses in exchange for handing over data on the banks’ customers, a sign of the likely tensions to emerge as the government looks to break open the banks’ information vaults. In a move that could have far-reaching implications for banks and their customers alike, Treasurer Scott Morrison earlier this year ordered an investigation into “open banking”, a system that would allow customers to securely share their financial data with rivals. While the banks are supportive of the general move, submissions to a Treasury have highlighted the cost of making more transaction data available, with suggestions banks could face costs in the hundreds of millions […]

Macquarie has beaten the Big Four to ‘open banking’, which lets customers offer their data to fintech startups

Fintech startups and smaller financial services providers will be able to access data from Macquarie – with customer consent – in a pioneering arrangement known as “open banking” to let them build applications and services around the bank. Open banking allows customers to control whether their data can be passed onto third parties with accounting software, budgeting tools and fintech apps. The idea is that it opens up the market to smaller players and gives customers more choice on financial services. While the government kicked off an independent review on open banking in July, Macquarie has taken the initiative in letting client data flow electronically to third parties through application […]