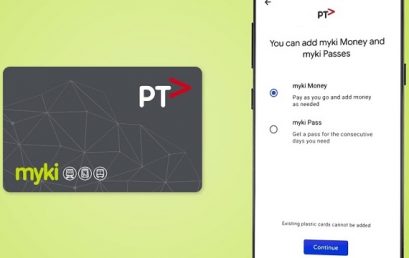

Victorians flock to Google Pay myki alternative

The number of Victorian commuters using Google Pay for public transport is nearing 100,000, just 11 weeks into the state’s new cardless myki scheme.

Uber is pivoting to fintech, something Asian startups have been doing for years

Uber is reportedly making a big push into financial technology. It’s a move that Asian mobility companies have been adopting since at least 2015.

Australian FinTech company profile #24 – Jinance

Jinance is Australia’s leading cryptocurrency exchange platform and provides cost effective access to blockchain technology backed cryptocurrencies

The Future of Banking is looking Up

Over 100,000 customers have joined Up since it launched in October 2018, making Up one of the fastest growing digital banks in the world.

Alternative lender partners with training institute to accelerate business growth

Beyond Merchant Capital have teamed up with The Entourage, Australia’s most effective business training institute to provide backing and direction to SMEs.

UK fintech Revolut launches in Australia

Revolut opened a beta version of its local app on Thursday, with nearly 20,000 Australians on its waiting list simply, the firm says, from word of mouth.

Tech enabled, hybrid advice model emerges

Absolute Advice created a hybrid model – a full service advice practice employing tools commonly associated with robo-advice for on-boarding and investment.

Melbourne’s fintech innovation hub Stone & Chalk to launch ‘Females in Fintech’ program

Australian fintech hub Stone & Chalk today announced a ‘Females in Fintech’ program in Melbourne beginning this month and funded by LaunchVic.