The app increasing your super while you spend

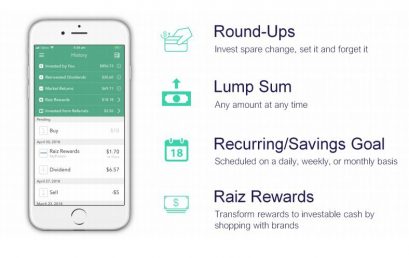

A new phone app is helping people get big returns on their retirement savings, and Nine News has revealed how you can start earning NOW with as little as five dollars. A new app called Raiz is helping consumers use their spare change to boost retirement savings through an easy-to-manage investment account. And former financial advisor Nathan Martyn said he has already saved hundreds. “I wanted to start paying attention to where my super was and how it was likely to generate over time,” Martyn told Nine News. Say Martyn uses his debit card to buy a coffee for $3.50, the figure is rounded up to the nearest dollar. In […]

How is fintech regulated and have we got it right?

One of the big questions yet to be answered when it comes to fintech is: how do we effectively regulate the industry? Normally, banks, credit unions or any other company that lends money comes under Responsible Lending regulations, and any institution that accept deposits need to be on the government’s list of Authorised Deposit-taking Institutions (ADIs). But fintech is all about innovative solutions and new ideas – which makes regulating it without stifling it a tricky thing to do. Here’s how a couple of the big regulatory players in the market are dealing with fintech at the moment: Australian Securities and Investment Commission (ASIC) AISC is responsible for not only […]

Affinity takes Scottish Pacific on first trip into the $4s

Affinity Equity Partners is offering more than $600 million for debtor finance company Scottish Pacific. Street Talk understands the private equity firm’s indicative bid values Scottish Pacific in the “mid to high $4s” a share range, and was made subject to due diligence, funding and the sorts of approvals usually seen when a buyout firm knocks on a listed company’s door. For Scottish Pacific, it means there is no real rush to do anything. If there is to be a takeover, it would be months away. Nothing it says or does in the next 24-hours is expected to move the dial, now that Affinity has made its approach. Scottish Pacific […]

Digital banking and neobanks

If all you’ve ever known is dollarmites and the big four, the idea of an online bank may seem a bit intimidating to you. But as banks roll out new app features and handy online services, the reliability of online banking grows, and makes room for digital banks and neobanks to emerge. If you’re curious about the world of online banks, we’ve answered some frequently asked questions below. What is digital banking and what online-only banks are there in Australia? Digital banks, or online-only banks are exactly what they suggest, banks that operate online through a computer or app on your phone. This means they don’t offer in-branch service like […]

Sydney fintech Frollo scores $65,000 grant to take “Fitbit for finance” app to the next level, and reduce stress for Australians

Fintech startup Frollo has taken home a $65,000 grant from the MetLife Foundation, having been named best financial solution for low- to moderate-income Australians at MetLife’s Inclusion Plus competition for its gamified personal finance solution. Established in 2016, North Sydney-based Frollo is a personal finance app that uses gamified features to help users identify and change bad spending habits. The startup also licences its software to financial institutions and challenger banks, and founder and chief Gareth Gumbley tells StartupSmart it now has “tens of thousands” of users — a figure that is “edging towards the hundreds of thousands”. Gumbley has a background working in a consumer finance business and saw a […]

‘The clock is ticking for banks’: Morgan Stanley warns banks need to up their game before they get disrupted

Banks need to transform themselves or they’ll be left in the dust by new fintech companies, according to a new report. With fintech companies raising $58 billion globally in the first half of 2018, banks are feeling more pressure than ever to spend on their own technology. This is compounded by the fact that fintech companies don’t suffer from legacy IT systems and can provide banking services 50% cheaper than big banks. “Pressure is mounting for banks to innovate and disrupt themselves fast, before someone else ‘eats their lunch’,” Morgan Stanley analyst Betsy Graseck wrote in the report. Big banks are already stepping up their tech investments in response. JPMorgan’s […]

Fintech Prospa has now written $750 million in loans

Fintech Prospa, a lender to small business which in June postponed an ASX-listing after being pinged about unfair loans terms, says it has now written $750 million in loans. Loans for the year to June were $367 million, a 70% increase on the previous 12 months and 9% higher than prospectus forecasts with strong momentum in the fourth quarter. For the six months to June 2018, loans hit $211 million, up 16% on prospectus forecasts and up 61% on the previous corresponding period. Earlier this month Prospa confirmed it had removed or amended some of its contract terms seen as unfair following a review by corporate regulator ASIC. Among the […]

Fintech 101: Core concepts for the future of banking

Everyday it feels like someone, somewhere has coined a new banking term. But as Australia continues to take big steps towards innovation, the average Aussie might feel left in the dark when it comes to understanding what’s in store for the future of banking. So to keep you in the loop with all the latest in fintech, we thought it might be worth getting the basics down first. What is fintech? Put simply, fintech stands for ‘financial technology’ and can refer to any technology that is used in the finance industry to provide products and services. Just remember that fintech usually refers to newer, innovative products and services. For example, […]