Up launches conversational payments

Up, the digital banking platform that went live in October 2018, has today launched conversational payments in app for customers. An Australia first, the experience will bring functionality on par with the United States, Europe and China, where Venmo, SquareCash and WeChat Pay have significantly altered and improved customers’ payment experience. Up’s Chief Imaginer, Anson Parker, says many Australians will not have experienced this approach to payments before. “Driven by Osko, payments are made in real time to friends and merchants – there’s nothing ‘pending’ here. And we’ve built this platform from the ground up to enable the conversational format that gives customers clarity on where money is going to […]

Retreat & Destroy: what R&D reforms are doing to start-ups

For a government that is threatening to wipe out a significant number of tech start-ups with its proposed changes to the research and development tax incentive, it shouldn’t come as a surprise the Morrison government appears to have failed to do any research into the potential impact. After all, if the government had conducted its own study it would know that R&D tax incentives are the unsung hero of the start-up world, and reducing accessibility could be the death knell for innovation in Australia. But this is the same government that is without a minister focused only on innovation and one that has reduced spending on science, research and innovation […]

Cashflow group appointment to help expansion

A cashflow finance group has appointed a new manager to oversee operations as it continues to grow Australia-wide. Australian Invoice Finance (AIF), which launched in August 2017, has hired Chris Allchin as senior manager to set up its Victorian and Tasmanian operations and spearhead sales growth in both states. Allchin, who is based in Melbourne, has 11 years’ experience in SME finance, most recently at FactorONE, where he was a business development manager for four and a half years, focusing on management of broker relationships and potential leads in Victoria. He said he was extremely pleased to be joining AIF after a refreshing six-month break from professional services. He added, […]

Stablecoins could lead cryptocurrency growth in 2019

With Bitcoin making a shaky climb closer to $4000, the entire industry of cryptocurrency is still reeling from hitting a relative low on the year last week. Since the start of the year, the number one cryptocurrency by market capitalization is down nearly 80 percent since peaking close to $20,000 in December 2017. For some, the falling price of Bitcoin and the broader altcoin has raised the alarm and led to widespread selling out, negativity and a soured mood towards crypto and blockchain-based assets. Just yesterday, EWN reported on the significant number of crypto-based startups which have been forced either to close shop or make substantial staff cuts in response […]

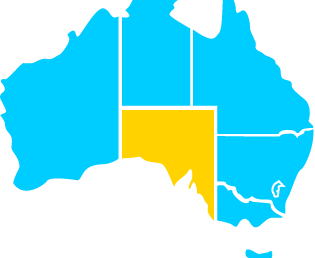

SA govt launches blockchain challenge to spur industry

Offers $100,000 prize pool to entrepreneurs. The South Australian government is hoping to forge its position as Australia’s “blockchain capital” through a new $100,000 challenge for entrepreneurs. On Wednesday it launched the blockchain innovation challenge, inviting South Australian residents (or those willing to relocate) to pitch ideas that solve problems using blockchain. The government hopes to use the competition as a means to attract blockchain enterprises and make the state as Australia’s “blockchain capital”. “The South Australian Government recognises this potential and is working to create the right environment for blockchain enterprises to thrive,” it said. It is calling for “well-thought out projects” that hold the promise of benefiting the state […]

Australia punches above its weight with Blockchain Innovation

ACS, the professional association for Australia’s ICT sector, today announced the publication of Blockchain Innovation: A Patent Analytics Report at Barangaroo, Sydney. Through providing insight into innovators in blockchain technology – based on patents filed – the report will assist both businesses and governments in understanding the technology and the degree to which it is a critical enabler for continued economic growth. ACS President Yohan Ramasundara said, “Blockchain has been hyped as one of the most transformative and disruptive technologies on the immediate horizon. With the global market forecast to grow to US$60 billion by 2024, Australian businesses and governments alike have ample opportunity to leverage the technology as it matures.” The […]

Temenos acquires Australian banking fintech Avoka for US$245m

Temenos, the banking software company, today announces it has agreed to acquire Avoka, a leader in digital customer acquisition and onboarding, subject to regulatory approvals. The acquisition further strengthens the Temenos Digital Front Office product, which has over 300 banking clients and has been recognized as a leader by top analyst houses such as Forrester and Ovum. The Avoka platform will be integrated with the Temenos Digital Front Office product, providing banks with a comprehensive single solution for their omni-channel digital banking needs. Temenos has agreed to purchase Avoka for USD 245 million. Through this acquisition, Temenos continues to bring innovative capabilities to its Digital Front Office product that includes […]

Keeping up with data in the financial landscape of the future

By Scott Hubbard, Managing Director ANZ, MapR Changing consumer behaviour and the growing need for customer centricity are reshaping the banking and financial services industry (BFSI), however underpinning this is data and applications. We are now living in a world where a massive amount of data is being generated by an increasing number of sources and it’s up to organisations to take advantage. In fact, IDC reports that worldwide revenues for big data and business analytics will reach $260 billion USD in 2022. For banks, the increase in both scale and speed of their applications and data processing, means they can leverage data analytics to create better services for […]