RepuCoin secure blockchain defends against attackers

In what its originators have billed as a ‘world first’, a secure blockchain has been developed that they claim can defend against malicious activity. Monash University researchers are part of an international team that created the system, which, it is claimed, can successfully block malicious activity by attackers who possess more than half of the system’s computing power. The system, RepuCoin, introduces the concept of ‘reputation’ to blockchain, supposedly making it thousands of times more expensive to attack than Bitcoin. Its creators claim it has the potential to be applied in a number of global sectors including fintech, energy, food supply chains, health care and future 5G telecommunications networks. RepuCoin’s […]

Why more Aussies are turning to peer-to-peer loans

The Royal Commission into the banks and financial services unveiled a series of disturbing, infuriating and unsurprising truths. Australia’s response to the findings could send tremors through the financial services sector as the search for alternatives to the incumbent providers becomes more urgent. It means peer-to-peer loans – which have already seen significant gains – could become even more prominent in the lending landscape, the CEO of peer-to-peer loan provider SocietyOne, Mark Jones believes. SocietyOne is an online peer-to-peer loan platform, connecting investors’ funds with borrowers’ needs. The majority of loans SocietyOne writes are personal loans. Speaking to Yahoo Finance, Jones said Australians have been resigned to accessing credit from […]

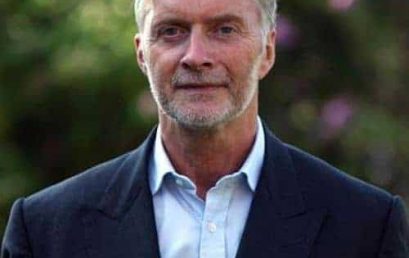

Interview: Anthony Thomson, 86 400 – roaming numerals

In an exclusive interview, Anthony Thomson, chairman of Australian challenger bank 86 400, tells FinTech Futures about what makes it different from its rivals, and why the big four Down Under got what they deserved. Most people don’t want to be the same as others and strive to be different and stand out. For challenger bank 86 400 (pronounced eighty-six, four-hundred), up against plenty of other Australian rivals such as Xinja and Volt, Thomson wants to make it known about its distinctive qualities. “Unlike others, we made the decision to apply directly for a full banking licence, rather than piggyback off another licence, or via the restricted licence route.” The […]

Banks must prioritise NPP, says Reserve Bank

The $1 billion New Payment Platform seems to be another headache for the big banks. Reserve Bank governor Philip Lowe asked the chief executives of the big four to confirm they are putting significant resources into rolling out the high speed payment system last year. In emails sent by Lowe to the chief executives of ANZ, Commonwealth Bank, Westpac and National Australia Bank last September, he expressed concern at how long it was taking to roll out the high speed payment system, saying: “The concern is that the slow roll out is limiting both competition and innovation.” He went on to write: “Given these issues, the board has asked me […]

Westpac abandons financial advice

Westpac will get out of the troubled personal advice sector and two of its top executives will depart the bank as it joins its big-four rivals in abandoning the once-dominant model of vertical integration. The bank announced on Tuesday it would exit the high-cost, loss-making business, producing $280 million in savings by 2020. Westpac group executives George Frazis and Brad Cooper will leave the bank as part of the changes. Westpac chief executive Brian Hartzer said most customers did not differentiate between banking and wealth products and just wanted help to buy a home or plan for retirement. “We’re realigning our capabilities into the lines of business where it makes […]

A fintech wanting to be ‘Australia’s leading migrant bank’ has launched a $4 million placement

There are plenty of fintechs and plenty of small caps seeking money from Chinese consumers, but few companies that are both. Novatti (ASX: NOV) is one of them. The ASX-listed small cap is a holding company for half a dozen fintech platforms. One of these is chinapayments.com which allows Chinese people in Australia to pay Australian utilities bills through AliPay. They receive fees on a per-transaction basis for payments through the platform. In December, the volume was around $200,000 a month but in January this rose to $460,000. For those with loved ones back home, they can send money overseas through TransferBridge or MoniSend, or alternatively pay bills on their behalf. […]

Digital wallet payments surge on Apple Pay: CBA

The Commonwealth Bank says the number of digital wallet transactions has nearly tripled since it launched Apple Pay earlier this year, as strong growth in tap-and-go payments continues to displace cash. After CBA in late January became the second big four lender to offer the payment service — which allows consumers to make purchases by tapping their phone on a merchant terminal — there has been a clear surge in people paying with iPhones. “Since we’ve introduced Apple Pay, we’ve seen the number of wallet transactions that are linked to a card increase 2.7 times. So it’s really increased quite dramatically since we’ve introduced Apple Pay for our consumer customers,” […]

UBank launches world’s first consumer Green Term Deposit certified by the Climate Bonds Initiative

UBank is now offering Australians with a sustainable way to invest with today’s launch of the world’s first Green Term Deposit in the customer space certified by the Climate Bonds Initiative (CBI). UBank’s Green Term Deposit is matched to a portfolio of renewable energy projects such as wind and solar power, and low carbon transport and buildings. It allows customers to use the savings in their term deposits to support a positive environmental impact, while still enjoying a high return. Certified by CBI, a not-for profit that has developed a standard for investments which address climate change, UBank’s Green Term Deposit is available to all customers with a minimum $1,000 […]