Civica announces partnership with LanternPay for new claim payments solution

Civica, the market leader in business-critical software, digital solutions and managed services for the public sector and regulated markets, has announced it is partnering with digital claim payments platform LanternPay to develop a cloud-based and user-friendly online solution for health insurers and healthcare providers. “Civica has always been dedicated to improving efficiency and choice in the Australian health sector and we are delighted to be working with LanternPay in providing a new state of the art, cloud based online claim payments solution. This innovative solution will challenge the status quo and give health funds and service providers improved functionality and real choice in the claim payments arena” says Vinay Chand, […]

New Square Invoices app helps small businesses get paid fast

Today, global payments provider Square announced it’s releasing the standalone Square Invoices app, providing small businesses with a self-serve tool for creating, managing, and sending electronic invoices no matter where they are. From sending quotes and requesting deposits, to issuing recurring invoices and automated reminders, the Square Invoices app adds all the extra functionality small businesses need to ensure they get paid fast. Australian payment times have been identified as among some of the worst in the world, with invoices paid on average 27 days late. With the Square Invoices app, businesses can get paid quickly and easily in just a few taps – no more mailing invoices and […]

Pay-passing the hat around: From buskers to churches, a cashless society is Australia’s future

It’s becoming ever more apparent that as a society, we’re veering more towards being completely cashless, with solutions for giving and receiving money continually popping up and challenging everything we thought we knew about transacting. Not only is new technology and state-of-the-art security helping to boost consumer confidence when it comes to transacting electronically, but financial technology or ‘fintech’ is streamlining our financial interactions — making it easier and more reliable than ever before. According to the RBA, in the early-2000s, Australians went to an ATM an average of 40 times per year, but today, we go to an ATM about 25 times a year — a downward trend that is […]

Australia’s Consumer Data Right to open banking

by Doug Morris, CEO, Sharesight In collaboration with Fintech Australia, Sharesight has officially endorsed a submission on the Treasury Laws Amendment (Consumer Data Right) Bill 2019 that seeks to create the Consumer Data Right (CDR) with an amendment to the Competition and Consumer Act 2010. The Consumer Data Right (CDR) will mandate that banks and financial institutions (before later extending to telecommunications and utility providers) make it easy, safe, and practical for consumers to share their data with third parties — including competing services. It’s one of several critical ingredients needed to improve the financial outcome for Australians. Open Banking initiatives are already in place in the UK, and progress […]

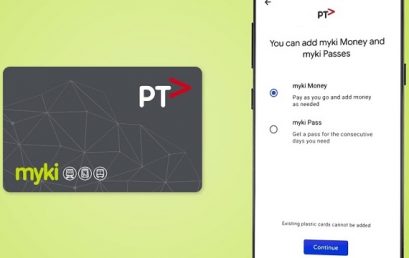

Melbourne commuters will soon be able to ditch their Myki and use their mobiles instead

Melbourne commuters will be able to ditch their Myki and use their Android smartphones to pay for public transport starting Thursday, but users of Australia’s most popular smartphone, the iPhone, are going to have to wait. Android users will be able to use Google Pay to handle their public transport expenses with a minimum top-up of $10, Public Transport Victoria said. This will remove the need for users to physically carry their Myki card. As long as the user is running the Android 5.0 operating system and has a near-field communication chip for contactless transactions, they’ll be able to use the system. Apple smartphone owners will have to wait for […]

Australian fintech Airwallex confirmed as latest fintech unicorn following Series C fundraising

Airwallex confirms unicorn status following a successful Series C fundraising round of $100m USD, valuing the company at over $1bn USD. Founded in Melbourne in 2015, Australian fintech Airwallex has grown from an emerging start-up to a global challenger in the crossborder payment space, supporting a client base of internet titans including JD.com, Tencent and Ctrip, and large financial service companies including MasterCard. Top-tier investor DST Global led the Series C fundraising round, which closed at $100m USD. DST Global has been a primary investor across a number of global technology success stories, including Facebook, Airbnb and Spotify, and other fintech leaders, such as Robinhood. Alongside new investor DST Global, […]

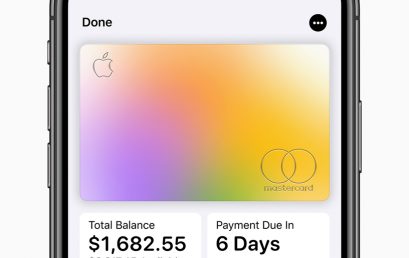

Apple Card is a credit card you can sign up for and start using with your iPhone

Apple’s getting into the credit card business with Apple Card, a new way to pay if you own an iPhone. It’s a credit card directly from Apple housed in the Wallet app, with no fees, lower interest rates, cash rewards, while also being private and secure. The announcement comes from the company’s event in Cupertino, California, where it debuted other services like Apple TV Plus, Apple Arcade, and Apple News Plus. Apple said retail acceptance of Apple Pay, which allows for contactless payments with your iPhone, is almost at 70 percent in the U.S., and in countries like Australia, it’s at 99 percent. Apple Pay will be in more than […]

Borrowers switch to P2P lending for home loans

The irresponsible lending practices uncovered by the year-long inquiry by the Royal Commission on big banks seemed to have pushed borrowers to alternative lending providers, the CEO of peer-to-peer loan provider SocietyOne said. SocietyOne’s Mark Jones told Yahoo Finance that peer-to-peer loans have already gained traction in the industry. In fact, figures from the Australian Bureau of Statistics show that personal loans’ share of the lending market doubled from 14% to 28% between 2010 and 2018. Meanwhile, data from CommSec reveal that borrowing from non-bank institutions grew 10.3% in August 2018. “The reality is people trust the big four banks as secure, and they actually trust their local branch manager. […]