Australian FinTech company profile #64 – SendGold

SendGold gives people the power to build and transfer their wealth, outside of the banks, across borders and across generations, using gold, history’s most reliable safe haven asset.

Australian FinTech company profile #50 – GoldFund

Put simply GOLDFUND (GFUN) is helping near term precious metals producers get into production by providing the capital they need.

95% of SME owners stay in work mode even on vacation

New research by leading online lender OnDeck highlights the challenges SME owners face trying to take time off from their business.

Australian FinTech company profile #4 – Gobbill

1. Company Name: Gobbill 2. Website: www.Gobbill.com 3. Key Staff: Shendon Ewans (CEO & Co-founder), Quentin Marsh (CTO & Co-founder) 4. Location(s): Melbourne based, Australian company. 5. In one sentence, what does your fintech do?: Automate bill payments by extracting invoice details, checking for fraud and paying using card or bank accounts. 6. How / why did you start your fintech company?: The co-founders were in a pub talking about the idea after missing some bills. We wanted to make our life admin easier, then Gobbill was used by our families and friends. It grew from there. 7. What the best thing your company has achieved or learnt along the way (this can […]

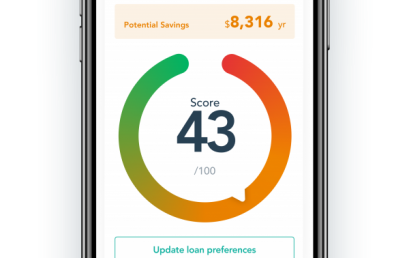

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

Bitcoin is safe, sustainable and here to stay

“Tulips”, “Ponzi scheme”, “fraud”, “only used by criminals and drug dealers’” have been some of the descriptions of Bitcoin in the past few weeks. Whether or not “fake news” is driving the price, the mystique of Bitcoin is enhanced by the fact that its “true” value cannot be determined using traditional financial analytical techniques. That mystique, however, does not justify the gulf between the bad press and what the facts show. For instance, former ASX boss Elmer Funke Kupper’s imputation that Bitcoin is “trade in drugs and other illegal products” drew instant scorn from Marco Santori, a regulatory expert and adviser to the International Monetary Fund at Cooley, a New York law firm. […]

Australia’s Alternative Finance Future goes from strength to strength

Australia is emerging as a regional leader in the $300bn global Alt-Fi market. Alternative finance (or Alt-Fi) is a catch-all phrase used to describe emerging, digital financial services models such as peer-to-peer and marketplace lending (business and consumer finance), crowdfunding and invoice lending. However, for Australia to stay ahead greater consumer and business awareness is needed as well as policy and regulatory settings that continue to evolve with the development of this nascent sector. Globally this market is expanding quickly, up 100 percent year-on-year, with China the dominant world market (in terms of absolute volume), accounting for 85 percent of the total market. A staggering US$243.28 billion was raised through […]

Some investors see bitcoin better than gold: Morgan Stanley

Bitcoin’s meteoric rise is leading some investors to argue that bitcoin is a better hedge against inflation and turmoil than gold, according to Morgan Stanley. Tom Price, a London-based equity strategist, said he’s been fielding more cryptocurrency questions after prices recently soared past $US4,000 ($5046) a bitcoin, a fivefold increase from November 2016. Both bitcoin and gold offer similar benefits as a store of value, such as being fungible, durable, portable, divisible and scarce, but it’s too soon to call bitcoin a superior investment, he says. “Over millenia, gold has demonstrated its ability to endure and preserve value under all circumstances,” Price said in an Aug. 14 report. “By contrast, […]