What does NPP mean for businesses and how on earth do they implement it?

Bitcoin isn’t a boy’s club, women just aren’t getting involved

by Chantelle de la Rey, Amber co-founder, product owner and lead designer. A common question I get asked is ‘why is Bitcoin a boys’ club’? And ‘how do you cope with being a female in three male-dominated spaces?’ Well, let me ask you some questions. Why do you think it is a boy’ club? Why haven’t you as a female entered the Bitcoin or digital-currency space? Why haven’t you bought Bitcoin? Please comment below or send me a message via social media telling me your ‘why’. Here are some common responses. ‘I don’t know enough about the space.’ ‘It doesn’t interest me.’ ‘Way too volatile.’ ‘OMG the news says Bitcoin […]

How Blockchain is boosting the Fintech Sector

The Financial Technology sector, commonly known as Fintech, has changed considerably over the years. From the introduction of ginormous super computers in the 1970’s that would struggle to compete with the average phone for power these days, technology has advanced the finance world. The 1980’s saw automated stock exchanges and the increased use of computer technology in everyday banking. The 1990’s brought the advent of the internet, changing our lives as well as the financial sector. Slowly but surely, mobile banking, internet banking, personal loans, insurance renewal, forex trading and more crept into our lives bringing disruption to the financial world. What was once the preserve of big banks and […]

SME lending is a valuable source of diversification for brokers says fintech lender OnDeck Australia

The Banking Royal Commission has highlighted the perils of relying on a single revenue stream, and SME lender OnDeck Australia is urging mortgage brokers to think beyond home loans and diversify into SME lending. Research by commercial lending fintech OnDeck Australia[1] confirms that 25 percent of Australia’s small to medium enterprises plan to seek additional business finance. Michael Burke, Head of Sales at OnDeck Australia, says, “There is clearly strong demand for SME finance, making this a revenue channel that brokers cannot afford to overlook. Moreover, our discussions with brokers indicate that, on average, one in four of a broker’s existing home loan clients are SME owners, providing a ready […]

Blockchain boost as HSBC links Australia and China

Blockchain has long been cited as one of the upcoming technologies to solve many of the world’s current financial problems when it comes to cross-border trade, and it appears to have taken another step forward this week as HSBC confirms it has been able to link a transaction between Australia and China. The development is based on the use of a Letter of Credit (LC) format, which is typically a paper-based format that makes up a significant proportion of trading in China and being able to digitize this is expected to create plenty of savings in terms of time and invested resources. HSBC set up the link between two of […]

The Winners of the 2019 Fintech Business Awards have been announced

The Winners of the 2019 Fintech Business Awards have been announced. Congratulations to all the Australian fintech companies and leaders – well done! Individual categories Femtech Leader of the Year Jodi Stanton – SendGold Fintech Entrepreneur of the Year Ruth Hatherley – Moneycatcha Fintech Mentor of the Year Peta Tilse – Sophisticated Access Fintech Thought Leader of the Year Charmian Holmes – The Fold Legal Fintech Business Excellence Award (Individual) Ruth Hatherley – Moneycatcha Company categories Accounting Innovator of the Year Class Limited Compliance Innovator of the Year Advice RegTech Financial Advice Innovator of the Year Myprosperity Fintech Start-Up Business of the Year Trade Ledger Insurance Innovator of the Year […]

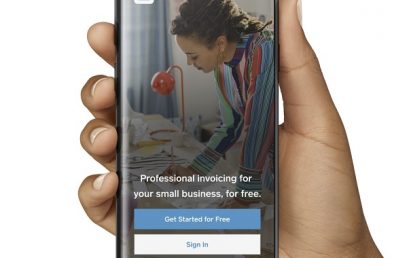

New Square Invoices app helps small businesses get paid fast

Today, global payments provider Square announced it’s releasing the standalone Square Invoices app, providing small businesses with a self-serve tool for creating, managing, and sending electronic invoices no matter where they are. From sending quotes and requesting deposits, to issuing recurring invoices and automated reminders, the Square Invoices app adds all the extra functionality small businesses need to ensure they get paid fast. Australian payment times have been identified as among some of the worst in the world, with invoices paid on average 27 days late. With the Square Invoices app, businesses can get paid quickly and easily in just a few taps – no more mailing invoices and […]

Australian fintech Airwallex confirmed as latest fintech unicorn following Series C fundraising

Airwallex confirms unicorn status following a successful Series C fundraising round of $100m USD, valuing the company at over $1bn USD. Founded in Melbourne in 2015, Australian fintech Airwallex has grown from an emerging start-up to a global challenger in the crossborder payment space, supporting a client base of internet titans including JD.com, Tencent and Ctrip, and large financial service companies including MasterCard. Top-tier investor DST Global led the Series C fundraising round, which closed at $100m USD. DST Global has been a primary investor across a number of global technology success stories, including Facebook, Airbnb and Spotify, and other fintech leaders, such as Robinhood. Alongside new investor DST Global, […]