OnDeck Australia ranks among Australia’s Top 40 “Best Places to Work”

OnDeck Australia now has the highest designation available as one of the nation’s “Best Places to Work” in Australia.

Over 16,000 Australian small businesses learn their credit score via OnDeck

OnDeck first launched its ‘Know Your Score’ online scoring calculator in 2016. Since then, it has delivered over 16,000 scores to Australian businesses.

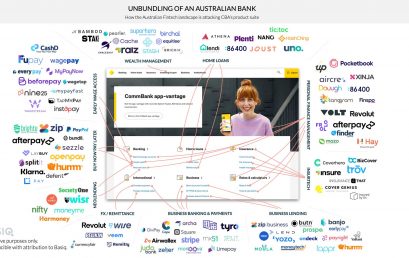

Unbundling The Big Four – What’s Next?

Australian Fintechs are unbundling the products and services offered by the Big Four and are moving toward ‘Rebundling’.

Rich Data Corp presents research findings at prestigious artificial intelligence conference

It is a win-win for financial institutions and borrowers when it comes to using advanced artificial intelligence to assess non-traditional credit histories.

Household Capital passes on more than the RBA interest rate reduction

Responding to the RBA’s 0.15% interest rate reduction, Household Capital went further, lowering its rate by 0.20% to a home equity access rate of just 4.95%

Smartbank 86 400 launches in Australia

Australians are waking up to a smarter way to bank as smartbank 86 400 becomes available nationwide, built so customers can bank directly from their phones.

SME lending is a valuable source of diversification for brokers says fintech lender OnDeck Australia

The Banking Royal Commission has highlighted the perils of relying on a single revenue stream, and SME lender OnDeck Australia is urging mortgage brokers to think beyond home loans and diversify into SME lending. Research by commercial lending fintech OnDeck Australia[1] confirms that 25 percent of Australia’s small to medium enterprises plan to seek additional business finance. Michael Burke, Head of Sales at OnDeck Australia, says, “There is clearly strong demand for SME finance, making this a revenue channel that brokers cannot afford to overlook. Moreover, our discussions with brokers indicate that, on average, one in four of a broker’s existing home loan clients are SME owners, providing a ready […]

The sacrifices of running a small business in Australia

A new YouGov study of small businesses in Australia has found the lengths that small businesses owners go to make a success of their ventures. The research, commissioned by Australia’s number one online lender to small business, Prospa, shows that more than half (54%) of small business owners spend 6-7 days a week on their business, with one in four (28%) working 7 days a week. Even when not at work, small business owners continue to be engrossed, with almost three-quarters (73%) agreeing that concerns around their business prevent them from relaxing during the holiday period. Overall, nine in ten small business owners feel distracted by work in other areas of their […]