White label BNPL fintech Limepay lands major retail partnership with Accor Plus

Enterprise payments fintech Limepay has secured its first major retail partnership with Australia’s largest hotel operator, Accor.

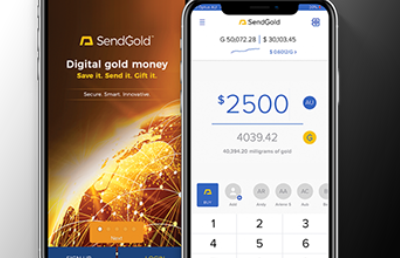

Australian FinTech company profile #93 – Send

Send are delivering a truly global payments platform to our customers and partners that connects people with their money like never before.

Klarna and BigCommerce extend partnership to Australia

Payments provider Klarna and SAAS ecommerce platform BigCommerce have announced the further expansion of their partnership into the Australian market.

COVID carnage: Limepay raises $6m to help merchants take control of BNPL

The lifeline this gives to merchants couldn’t be more timely, according to Limepay Founder & CEO, Tim Dwyer.

Lakeba Group backs Appreci to help scale its gratification 4.0 platform globally

Lakeba Group has taken a 35 per cent stake in Appreci, to help scale the gratitude platform globally.

Square rolls out timesaving Square Appointments app to Australian businesses

Square is today rolling out Square Appointments in Australia, an all-in-one scheduling solution custom-built to save businesses time.

Is Google trying to kill Bitcoin?

Google, the internet search giant that owns YouTube and the Android mobile operating system, has a fraught relationship with bitcoin and crypto.

Sydney Fintech opens fund raise for $6M with extensive growth plans for digititalised gold

SendGold’s technology platform enables customers and businesses to hold and instantly exchange history’s most reliable safe haven asset, gold bullion.