Non-banks are the future of banking

The future of banking is in the hands of non-banks, says specialist lender Liberty. Non-banks, by nature, are “active, nimble, innovative and relevant”, allowing them to lead the competition, rather than be threatened by big banks. Non-banks provide a variety of solutions such as home loans, car loans, personal loans and business loans, as well as custom lending for those that need it. But as the financial world welcomes more and more technology, and increased regulation drives up costs, it leaves many to wonder how non-banks will respond to these changes. Asked about how non-banks will adapt to the future, group sales manager at Liberty, John Mohnacheff, laughed: “How are […]

How the rich invest: Afterpay’s Nicholas Molnar makes a cool $200 million

The tearaway market success of Afterpay Touch Group has however supercharged the fortunes of its 28-year-old co-founder Nicholas Molnar. Afterpay is fast becoming the go-to payments platform for Millennial shoppers who want to own products immediately but pay for them in instalments. The instalment service is growing rapidly. It has more than 1.8 million customers and is growing at roughly 3300 new customers per day. There are now 14,000 retailers using the service; it will soon be available for buying Jetstar flights and in May announced it was transacting in the US after cutting a deal with retail powerhouse Urban Outfitters. The potential for growth in the US has been […]

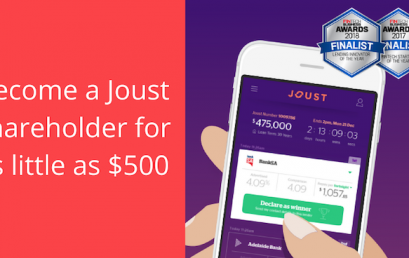

Adelaide fintech startup Joust seeking to raise $2m in Equity Crowd Funding

Adelaide fintech startup Joust is launching an equity crowdfunding campaign via OnMarket and is hoping to raise $2 million to rapidly scale the business. The Joust platform, launched in 2016, links borrowers with more than 20 lenders who compete against each other to offer the lowest interest rate via a reverse auction process. Using equity crowdfunding platform OnMarket, the company plans to spend a large portion of the money raised on advertising, with the remaining funds to go towards product development, potential entry into overseas markets and building out the Joust team. A minimum $700,000 is being sought as part of the capital raise, which allows retail investors to invest between $500 […]

Younger advisers drive digital client engagement

Financial planners are increasingly looking for digital means to engage clients, latest Investment Trends research shows. The majority (88%) of advisers are strengthening their client relationships using technology-based solutions to interact and disseminate information, this year’s Planner Technology Report found. The younger generation of planners are driving the digital client experience trend, starting with virtual client meetings. Investment Trends research director Recep Peker said this group expects tablet-enabled client meetings and the use of interactive modelling tools during client meetings to become the norm. Peker added the results provide an opportunity for platforms and planning software providers to collaborate with planners. “Technological advancement is rapidly increasing consumer expectations, a so-called […]

Digital cash not on RBA agenda

The Reserve Bank has poured cold water on the idea of a digital Australian dollar, with head of payments policy Tony Richards declaring the demand isn’t there. A group of Australian fintech start-ups through industry body FinTech Australia last year wrote a letter to the RBA calling for a new digital currency, known as the ‘DAD’ or Digital Australian Dollar. “A centrally issued Digital Australian Dollar, backed by fiat [physical] currency, would enable payments to be made between participants in real time and 24/7 along the supply chain,” AgriDigital co-founder Emma Weston said last year. Meanwhile Othera CEO John Pellew said in the letter a ‘DAD’ would help his company […]

Comprehensive credit reporting laws will drive innovation and protect banks

In the blue corner, lining up to support the bill to ensure customer repayment history is provided in credit reports, are: the government, all of the banks, the entire fintech industry, the credit bureaus, the regulators (especially the Australian Prudential Regulation Authority), and many equivalent western economies such as the US, UK, Canada and New Zealand. In the red corner, lining up against it, are consumer groups and the Labor party. At the last election, Labor also supported “comprehensive credit reporting” like nearly everyone else, but this month decided to back a 12-month delay to the reporting of “repayment history information”, which sits at the core of the regime. Positions […]

YTML transforms high volume SOA changes

Fintech YTML has rolled out its newest automated solution which is helping to quickly generate high volumes of personalised Statements of Advice (SoAs) for simple advice. Terri Ho, YTML General Manager, Advice said having to write SoAs or RoAs for a change impacting a large group of clients is one of the most time-consuming, frustrating and expensive exercises for licensees and advisers. “Changes can come about for a range of reasons – a change of platform or the removal of a product from an Approved Product List, for example. If you have a big book of clients you will have a large number of SoAs or RoAs needing to reference […]

Put your money where your trust is

Why Nifty Personal Loans is the lender for you. In light of the recent fine laid down to the Commonwealth Bank of Australia for breaching anti-money laundering and counter terrorism laws, the credibility of Australian lenders has once again come under scrutiny. The massive $700 million settlement, the largest ever civil penalty in Australian corporate history, was agreed upon by CBA and the Australian Transaction Reports and Analysis Centre (AUSTRAC) earlier last week. It is said that CBA’s breach of anti-money laundering laws allowed large crime syndicates to launder funds through the bank’s ATM’s and Intelligent Deposit Machines (IDM’s). The bank and trusted lender failed to carry out appropriate assessment […]