Media Release – Turnbull Government backing FinTech

Prime Minister Malcolm Turnbull and Treasurer Scott Morrison today announced the establishment of an expert advisory group to help make Australia the leading market for financial technology – or FinTech – in the Asia Pacific region. Financial services is the largest sector of our economy, employing around 450,000 people and contributing over $140 billion to the economy last financial year. Although Australia is a leading financial services market in the region, the sector is becoming increasingly globalised and exposed to technological disruption. Many traditional financial products are being disrupted by the FinTech sector, which is well positioned to become a leading player in the Asia-Pacific. FinTech is at the cutting […]

Blockchain and how it will change everything

In May, British billionaire Richard Branson invited a select posse of entrepreneurs, venture capitalists and technology advisers to his Caribbean residence for an exclusive pow wow on an issue occupying some of the top markets minds in the world. The topic for discussion on the picturesque Necker Island was the “blockchain”. “Every now and then, something comes along that might just change everything. And this is one of those moments,” ASX chief executive Elmer Funke Kupper. In case you’re one of the many yet to wrap your head around the promising technology, blockchain, on a simple level, uses computer code to engender trust in digital-economy transactions. One of the attendees […]

‘EY Fintech Adoption Index’ – out today

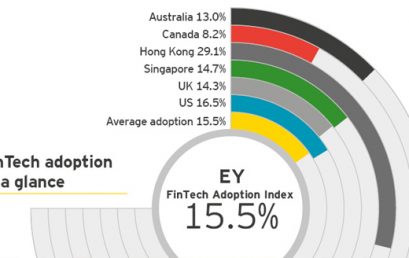

Ernst & Young have now released their ‘EY Fintech Adoption Index’ which outlines how quickly the market is taking up FinTech products. While we are a market leader in the adoption of credit card contactless payment technologies we are slow to take up FinTech products. As our market matures this is sure to change. Exploring a new financial services landscape Driven by innovative startups and major technology players, the booming FinTech industry is capturing traditional market share by offering customers easy-to-use and compelling products and services. We surveyed more than 10,000 digitally active people in Australia, Canada, Hong Kong, Singapore, the United Kingdom and the United States to better understand […]

CBA eyes collaboration with fintech companies in Asia and Europe

Kelly Bayer Rosmarin, CBA’s (CBA) Group Executive, Institutional Banking and Markets, said the Hong Kong and London labs highlighted the banks’ global approach to innovation that connected customers, employees and start-up communities to the latest fintech developments. “Hong Kong’s highly developed financial sector, strong entrepreneurial culture and proximity to China makes it the optimal location for us to establish an innovation presence in Asia,” she said in a statement. “The Hong Kong Lab will allow us to partner with the brightest minds across the city’s accelerator, government, university, start-up and fintech communities to further develop creative and innovative solutions for our clients.” Speaking in Hong Kong at the opening ceremony […]

Mutuals looking to fintech: KPMG

Australian mutuals are embracing innovation and fintech start-ups at an elevated pace, with 62 per cent indicating a willingness to invest in new technologies to improve their business, says KPMG. A recent KPMG survey, Mutuals Industry Review 2015: Time to take off, found that 62 per cent of Australia’s credit unions, building societies and mutual banks (or ‘mutuals’) are inclined to invest in new technologies. KPMG Australia national mutuals leader Peter Russell said: “Because the price of new technologies has come down dramatically due to the lower costs of starting new businesses, good ideas can be turned into business applications at a fraction of the cost of five years ago.” […]

Listed fintech business to acquire Chant West

Independent Xplan customising provider Enzumo is set to acquire research house Chant West. Today’s News Acorns Grow Australia readies for soft launch ClearView enhances WealthSolutions wrap LIF to ‘devastate’ IFA numbers, O’Dwyer told Father and son duo join Fortnum RBA leaves cash rate on holdIn an announcement to the ASX yesterday, the listed fintech and e-learning service provider said it has entered into a conditional share purchase deed to buy Chant West for $9.5 million, including $6.98 million in cash and $2.52 million in shares at $0.28 per share. The deal is still subject to Enzumo shareholders’ approval. “Chant West’s research-driven services in the superannuation and pension markets, combined with […]

Profit prize of $800m awaits successful mortgage market ‘disrupter’

There’s an $800 million profit prize should a new player achieve the difficult task of replicating the success of supermarket discounter Aldi in the $1.5 trillion mortgage market, according to analysts. As the dust settles on the major banks’ results season, experts are increasingly mulling whether conditions are as good as they get and how vulnerable the industry is to the horde of new “fintech” disrupters and larger players with plenty of capital to deploy. Westpac chief Brian Hartzer was yesterday grilled on whether the banks were setting themselves up for similar pain being felt by Woolworths, once one of the most profitable supermarkets globally, by propping up margins for […]

Preference for digital payments makes Australian banking ripe for fintech disrupters

Australian consumers’ love of contactless payments has helped push the country up global rankings that measure the use of non-cash payments across the world. Australia had the fourth-highest number of non-cash payments per person in the world, the report by consultancy Capgemini and bank RBS said. There were more than 300 non-cash transactions per person a year, the report said, putting Australia behind only Finland, the United States and the Netherlands. This is an increased from a few years ago, when Australia was ranked sixth in the report, and the rise reflects strong growth in digital payments for smaller purchases, where “tap and go” services on credit and debit cards […]