The FinTech Report Podcast: Episode 45: Gino Farina, Principal, The Bondi Broker

The FinTech Report Podcast: Episode 45: Glen Frost interviews Gino Farina, Principal at The Bondi Broker.

Mambu report: Generative AI and regulatory changes to shape APAC financial services in 2024

Mambu’s annual Partner Predictions Report for 2024 delves into the trends that are set to shape the financial landscape in the year ahead.

Funding bolsters its BDM team

Funding has bolstered their NSW BDM team, welcoming Lauren Severino and Sam Hermon to service the growing need for bridging and construction lending in the state.

NextGen and CommBank enable Open Banking for mortgage brokers

NextGen has announced that the Commonwealth Bank of Australia has become one of the first lenders to enable Open Banking for mortgage brokers.

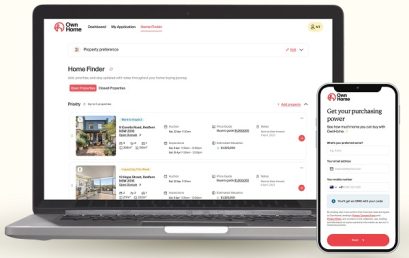

OwnHome launches Australia’s first 0% deposit home loan option to get more people onto the property ladder

CBA-backed OwnHome today launched the Deposit Boost Loan – an Australian first that will help aspiring buyers secure a bank loan with 0% deposit.

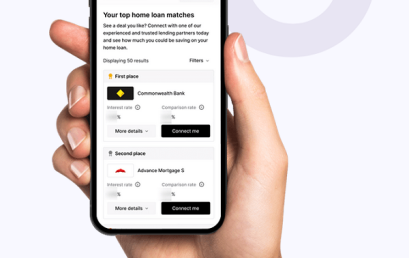

Joust partners with Lendela to expand financial empowerment

Home loan marketplace Joust have announced its partnership with Lendela, a prominent player in the personal loan industry.

Pioneering Australian fintech Joust navigates current market conditions with restructure and sale process

Joust announces a series of strategic initiatives aimed at bolstering the company’s financial health and repositioning the business in the current market

Bridging loan specialist Bridgit sees market changes and adapts product structure to meet new demand

Bridgit has been closely monitoring the needs of Australian homeowners alongside the recent market fluctuations.