Virgin launches new digital portal for mortgage applications

The lender has announced the launch of a new digital platform designed to improve the efficiency of the home loan application process for mortgage brokers. Virgin Money Australia has revealed that it plans to issue the majority of its home loan applications via its new Digital Acceptance Document Portal. The online delivery and signing platform is designed to provide customers with the opportunity to electronically receive and accept their Virgin Money Home Loans documents. The lender added that the platform, which can be accessed via multiple devices, would also allow brokers to view the progress of their customer’s application process. To read more, please click on the link below…. Source: […]

SocietyOne and Loan Market collaborate to broaden customer offering

Australia’s leading marketplace lender, SocietyOne, and Australasia’s largest family owned mortgage brokerage, Loan Market Group, have joined forces in a new partnership through which Loan Market will distribute SocietyOne personal loans. The partnership indicates a growing trend of brokers embracing alternative lenders in the wake of the banking Royal Commission, according to SocietyOne, as consumers are increasingly requesting banking alternatives in order to access a better deal. “The Royal Commission has uncovered a large number of issues within the consumer lending market, and both brokers and their retail customers have been equally exposed to the publicity surrounding this,” said Mark Jones, CEO of SocietyOne. “This has driven many brokers to […]

Fintech unveils mortgage under 3.5%

Fintech and online lender loans.com.au has unveiled its newest home-loan offering for owner-occupiers with a low interest rate of 3.48%. Dubbed the Smart Home Loan, the mortgage product is a principal-and-interest loan that has no ongoing fees and has a comparison rate of 3.5%. The product has a maximum loan amount of $1m and has several features such as redraw facilities and the ability to split and make additional repayments. Homebuyers can borrow as much as 80% of the value of their targeted property. Loans.com.au managing director Marie Mortimer said the new home-loan product aims to drive competition in the mortgage space and provide other options for borrowers who are […]

Power has shifted from banks to consumers: Bendigo Bank MD

A fundamental change in banking has occurred in a relatively short period of time: power has shifted from large financial institutions to consumers. In response, banks need to rethink how they serve their customers. That’s the view of Marnie Baker, managing director, Bendigo and Adelaide Bank. “The times are gone now where the power sits with the financial institution. The power is absolutely in consumers hands and they are dictating what they expect to see in an experience,” Baker told Which-50. Notably, the days of going to see a bank in their time and at their instruction have passed, Baker said, and today financial services need to be embedded into […]

Shadow banks swoop as five lenders quit sub-prime home loans

Digital home-loan lender Tic:Toc is launching into the sub-prime mortgage market targeting small business owners as five other lenders quit the sector claiming “industry changes”. Tic:Toc’s move follows stakes being taken in the online lender by Genworth Mortgage Insurance Australia and La Trobe Financial, which is part of the US investment giant Blackstone Group. Other major lenders, including Commonwealth Bank of Australia and Bank of Queensland, pulled out of the sector to be replaced by regulation-lite shadow banks, including Pepper Money and Resimac. Adelaide Bank, Perth-based Bluebay Home Loans and Resolve Finance’s mortgage division are also quitting the sub-prime sector blaming changing marketing and funding conditions. The move comes amid […]

UBank launches AI mortgage application assistant

A new artificial intelligence-powered mortgage application assistant will soon be able to answer customer questions in natural language, UBank has announced. UBank has revealed that its new AI-powered digital home loan application assistant, called Mia (short for My Interactive Agent), will start answering more than 300 common customer questions in real time from late February. The NAB subsidiary, which worked with FaceMe to develop Mia, said customers will be able to converse in natural language with the AI assistant via their desktop or mobile devices at any time about their mortgage applications. For example, customers could ask about what the variable rate of a loan is or what classifies as […]

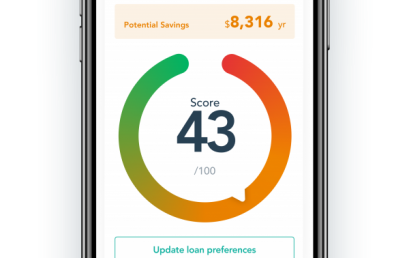

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

ANZ Bank buys into online mortgage broker Lendi

ANZ Banking Group has taken a strategic stake in online home loans platform Lendi. Street Talk understands ANZ paid close to $40 million for a minority stake, to become Lendi’s second largest strategic shareholder behind fellow Australian financial services giant Macquarie Group. Importantly for Lendi, which has 37 banks and lenders on its open home loans platform, the business will continue to be run independently and at arms length to its strategic investors. ANZ will not be given a board seat, as consistent with Lendi’s treatment of Macquarie and other strategic investors including Pepper. It is understood ANZ agreed to write the cheque after spending much of last year talking […]