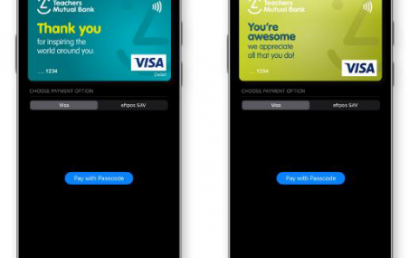

Teachers Mutual Bank Limited recognises teachers and nurses in a first for Australian card issuers

Teachers Mutual Bank Limited is innovating in the digital wallet space to recognise teachers, nurses and midwives.

Iress ceases divestment of UK Mortgages business

ASX-listed fintech Iress Limited today announced that it has decided not to proceed with the divestment of its UK Mortgages business.

MA Financial Group managed fund backs Funding.com.au in $37.5m debt and equity capital raise

Funding.com.au has concluded a raise of $37.5 million, securing a fund managed by ASX-listed MA Financial Group as its first institutional debt investor.

Property’s time in the sun – insights from Bernard Salt on what investors need to know

Bernard Salt discusses the demographic trends underpinning Australia’s property momentum and the growing interest in private real estate debt.

Housing trends over the past 30 years reveal hope for Australians looking to step on the property ladder

The Aussie Progress Report, considers several significant events which have shaped the Australian housing market over the last 30 years.

Deposit Power and Downsizer.com have partnered to launch an innovative “Deposit Power Downsizer Bond”

Deposit Power and Downsizer.com are delighted to announce the launch of the innovative Deposit Power Downsizer Bond.

The 5 pillars for better digital lending in 2022

Changing regulatory requirements demand constant attention, and lenders increasingly must look at ways of future-proofing digital lending.

Green home loans market is blooming

The number of green home loans tracked by financial comparison site Mozo.com.au has increased by 200% in the past 12 months.