Green home loans market is blooming

The number of green home loans tracked by financial comparison site Mozo.com.au has increased by 200% in the past 12 months, as the finance industry ramps up its transition to net zero.

The finding comes as financial institutions such as CBA continue to ramp up their investment in environmental, social, and governance (ESG) term deposits and Green Repurchase Agreement, which helps to increase the funding available for green home loans.

“It’s great to see a significant increase in green home loans available to borrowers, as lenders look to capitalise on the growing demand for green personal finance products,” says Tom Godrey, Mozo spokesperson.

Mozo’s analysis found of the nine green home loans in its database, the leading green home loan interest rate was 1.88%, offered by digital lender loans.com.au. This is 121 basis points below the average non-green variable rate of 3.09%.

“The good news for borrowers who are looking to purchase a sustainable property is that green home loans offer some very competitive interest rates, so going with a green option could not only help save you money, it could help save the environment as well,” Godfrey says.

Mozo’s analysis shows that by taking advantage of the leading green home loan rate you could save up to $2,922 a year on an average $400,000 owner-occupier loan paying principal and interest over 25 years.

Mozo’s database shows nine green home loans from five providers, with options for investors and owner-occupiers.

Provider | Green Product | Rate | Potential Savings |

Green Home Loan (Owner Occupier) | 1.88% | $73,043 | |

Gateway Bank | Green Plus Home Loan | 2.14% | $57,843 |

Bank Australia | Clean Energy Home Loan (Owner Occupier, LVR<90%) | 2.10% Variable intro rate for 60 months (2.30% revert rate) | $52,477 |

Firstmac | Green Basic 90 (Owner Occupier, Principal & Interest) | 1.99% Variable intro rate for 60 months (2.59% revert variable rate) | $43,415 |

Source: mozo.com.au as of 7 March 2022. Potential savings based on a $400,000 loan at 80% LVR for an Owner Occupier with Principal and Interest repayments over a 25 year period (average variable rate 3.09%). The savings figure does not include any upfront or ongoing fees. | |||

“Unlike traditional home loans, to qualify for a green loan your property will have to meet a range of environmental criteria set out by the lender,” says Godfrey.

Most green loans are only available for properties with a Nationwide house energy scheme (NatHERS) or Residential Efficiency Scorecard rating. As a general rule of thumb, a minimum 7-star rating is required, but some green loans are still on offer for homeowners who have installed certain environmental features on their property.

Mozo’s annual review of 441 home loans recognised Gateway Bank’s Green Plus Home Loan with the Mozo Experts Choice Award – Green Home Loan of the Year in 2022.

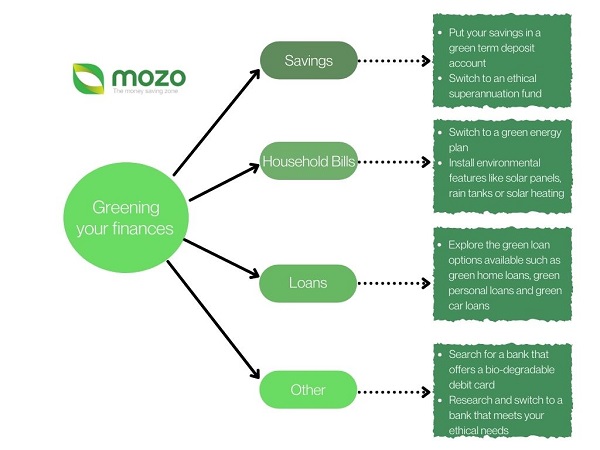

Green home loan tips:

If you don’t already have a Nathers or Residential Efficient scorecard rating, organise an accredited assessor to come to your property and provide a rating

If your property did not score at least a 7-star rating, consider upgrading your property with environmental features like rain tanks and solar heating

To help with financing environmental upgrades, consider taking advantage of discounted green personal loan

Compare the green loan options available to make sure you are getting the best deal