Neo-lender Wisr sees increase in banking defectors amid Banking Royal Commission

Neo-lender Wisr (ASX:WZR) has launched a bold new campaign targeting disillusioned customers of big banks, following the Hayne Royal Commission handing down its findings into consumer lending practices. The ‘Australia’s Getting Wisr’ campaign taps into the prevailing sense of unfairness that Australians feel towards the big banks and how customers can make smarter choices when seeking personal loans. The campaign in the coming months will showcase the company’s personal loan, financial wellness programs and new smartphone application. It is the first brand campaign undertaken by Wisr since launching the brand in March 2018 and will appear nationally on television and online from this week. Earlier this week the Hayne Royal […]

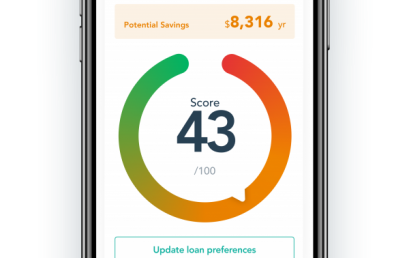

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

Crowd Property Capital’s Non Bank Development Funding Guide 2019 – rates and jargon explained

There are now numerous non-bank funding options available to developers and no shortage of lenders ready to deploy capital into quality projects with sounds fundamentals. The sector has matured over the last 2-3 years but there are many pitfalls (and a lot of jargon which we explain in the guide) to navigate. This guide looks to inform and assist developers considering non bank options for their projects. To download the guide, please click here.

Sydney fintech firm MoneyMe to invest $10m in Newcastle operations

SYDNEY-based fin-tech firm MoneyMe plans to invest up to $10 million in Newcastle and create about 100 jobs over the next three years. Co-founder Clayton Howes says the move to set up a Hunter office by MoneyMe, which specialises in offering fast credit up to $15,000 via mobile, has been a year in the making. The company will soon temporarily move 10 staff in the DASH co-working space in Charlestown and has earmarked permanent offices in the East End. Mr Howes said the company was impressed by Newcastle’s smart city credentials and innovation culture and saw its proximity to Sydney as an advantage. “It’s a bit like how San Francisco […]

Afterpay challenger Splitit up 90 per cent on first day of trade

Israeli fintech start-up Splitit has got the tech initial public offering market off to a cracking start for the year, with the payments-splitting company jumping 90 per cent on it first day of trade. Having raised $12 million and listed with an issue price of 20¢ on Tuesday, Splitit ended the day at 38¢, giving it a valuation of $100.3 million, having capitalised on the momentum behind peers such as Afterpay and Zip Co. The company, which was founded in 2012 by Gil Don and Alon Feit, has created technology that sits on top of the payments “rails” used by Mastercard and Visa to allow individuals to split the cost […]

Prospa contributes $3.65 billion to Australian GDP

Prospa, Australia’s number one online lender to small business, today revealed new research into the economic impact of its lending to small business in Australia. Prospa undertook the economic impact assessment in partnership with RFi Group and the Centre for International Economics (CIE). The project considered the value of funds lent by Prospa over the period 2013 – 2018 and assessed how funds have benefited Prospa’s customers through increases in revenue and employment and the flow-on effects of these funds to the wider economy. The results of the research showed: For every $1m in lending by Prospa there is a corresponding $4m increase in GDP Since 2013, Prospa has contributed […]

Chinese tech giant WeBank poised to disrupt Australian banking sector

Australian banks have a new reason to look over their shoulders as Chinese digital-only bank WeBank moves ahead with plans to establish a foothold Down Under. WeBank, which is valued at $US21 billion ($29.4 billion) and has written more than 100 million loans in its first five years in business, quietly began laying the foundations for its digital-only banking venture with a flurry of trademark applications on December 5 last year. With the aid of Adelaide-based legal firm KHQ Lawyers, WeBank is seeking to trademark the phrase “WeBank” and a series of Chinese characters that can be translated into English as “microloan”. The application lists the Chinese company’s Shenzhen headquarters […]

US firm triples its stake in Radium

Rocketing growth at a fledgling Perth fintech has prompted its US financial partner to buy a bigger slice of the firm under “a multimillion-dollar” deal. New York-based Brevet Capital has tripled its stake in Radium Capital to 50 per cent by buying stock from the WA group’s seven other shareholders led by company promoter Tony Brennan. Mr Brennan’s son David founded Radium with schoolmate David Weir nearly two years ago to give cash-poor companies quick access to the Federal Government’s research and development rebate. While others also operate in the same space, Radium believes it is differentiated from those rivals by its sole focus on the R&D rebate, proprietary technology […]