Australian banks are hunting for deals and partnerships with fintechs

The majority of Australia banks seeking deals and investments with fintechs in the next 12 months as they continue their transformation as digital businesses. The Australian findings from EY’s 2018 Global Banking Outlook show 80% of Australian banks looking to set up new partnerships or joint ventures in both core and new strategic markets over the next year. “With the pace of technological change and the speed at which new innovations are hitting the market, it’s not surprising that banks are increasingly focusing on their digital agendas,” says Tim Dring, EY Oceania Banking and Capital Markets Leader. “Australian banks have already made significant progress in this space and we are […]

Bitcoin plunges to a 2018 low with $55 billion wiped out as concerns mount

Bitcoin has slumped to its low for the year after seeing more than $US44 billion ($55 billion) in market value lost during January amid mounting concerns of increased regulation and the viability of the cryptocurrency. After reaching a record high of $US19,511 on December 18, Bitcoin has lost more half its value as the digital token has been weighed down by expectations of more government oversight globally, fears of price manipulation, the susceptibility of exchanges to hacking and lingering concern that it’s all just an asset bubble. Facebook announced a ban on cryptocurrency ads this week. Bitcoin declined as much as 12 per cent on Thursday to $US8796, the lowest […]

Ethereum has outpaced its rival cryptocurrencies since the start of 2018

Ethereum is the best performing major cryptocurrency so far in 2018. The second-largest coin by market cap has gained 46% since January 1, compared to the overall market’s 15% drop. The global cryptocurrency market might have lost 15% – or $US93 billion of value – since January 1, but not all coins have declined equally. Ethereum has fared well in 2018, avoiding the drastic selling that has left other coins in the red. The second-largest cryptocurrency by market cap is up more than 46% this year, according to Markets Insider data, far outpacing bitcoin’s25% decline. XRP, the third-largest cryptocurrency, controlled largely by its creating company Ripple, is down more than […]

Australia’s fintech industry wants to remove roadblocks for private company equity crowdfunding

Australia’s fintech industry has called for the fast adoption of stalled private company equity crowdfunding legislation to help more Australian small-to-medium sized businesses access the funds they need to grow. Legislation supporting crowdfunding for private companies was introduced to the House of Representatives in September last year hasn’t progressed. FinTech Australia chair Stuart Stoyan today called on Federal MPs to work together to give priority to the legislation when Parliament returns next week. He also called on legislation to start immediately after passing the Australian Parliament rather than a six month delay. The legislation would give hundreds of thousands of Australian businesses the ability to crowdsource up to $5 million […]

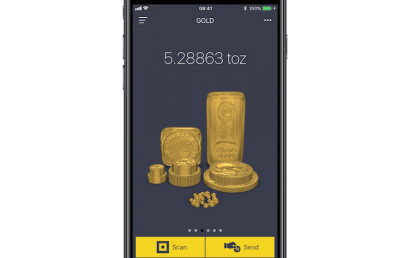

InfiniGold digital gold launches with The Perth Mint

In collaboration with The Perth Mint, InfiniGold has released the latest innovation in gold investment – a flexible digital gold product compatible with a wide range of technology platforms including blockchain. InfiniGold digital gold certificates offer institutions the opportunity to present investors with a new, secure and easy way to trade, hold and transfer physical gold. These digital certificates represent direct ownership of physical gold that is securely stored in The Perth Mint’s network of central bank grade vaults, which are located in the safe geopolitical environment of Western Australia. InfiniGold spokesman Sean McCawley said that InfiniGold certificates are the closest a customer can get to buying physical gold, in […]

Liberty buys MoneyPlace in personal loan push

Non-bank lender Liberty has purchased MoneyPlace, in a deal that will provide the marketplace lender with funding flexibility to target rivals SocietyOne and RateSetter along with the personal loan books of the big four banks. The acquisition suggests brokers, which currently facilitate half of all mortgages, will play a more influential role selling personal loans given Liberty’s deep broking relationships. It also suggests risk-based pricing of personal lending will become more common, given MoneyPlace and the other P2P lenders are willing to undercut bank interest rates for high quality borrowers. Liberty and MoneyPlace have not disclosed the price tag for the Melbourne-based platform, which has been operating for 18 months […]

This investment company is a step closer to a $3.5 million blockchain placement

First Growth Funds is a step closer to a blockchain-related investment with the green light from a leader in the field, Blockchain Global. In early January the pair announced a conditional placement led by Blockchain Global to raise $3.45 million for First Growth’s (ASX:FGF) expansion into the hot sector. Blockchain technology, which provides an encrypted, public ledger of transactions, is best known as the basis of cryptocurrencies such as bitcoin. But it has many other potential applications such as enforcing digital contracts, securing public records or regulating online voting. First Growth and Blockchain Global forged a partnership to identify blockchain-related investment opportunities. On Monday, First Growth announced the successful completion […]

China’s crypto start-up exiles like InvestDigital target Australia for ICOs

It was a futuristic deal. As the traditional capital markets took a breather in the days after Christmas, InvestDigital, a Chinese-based start-up building a funds management platform for crypto assets, raised $US23 million ($28.4 million) worth of the cryptocurrency Ether in an initial coin offering (ICO). It was also a landmark deal for the Australian market. After China last year put a halt to ICOs, the new form of fundraising allowing funds to be raised anonymously over the internet by issuing digital tokens, InvestDigital looked around for a country in which to base its offer – and chose Australia. Fintech lawyers and venture capitalists say this modern deal shows that […]