The finalists of the 2019 Fintech Business Awards have been announced

The finalists of the 2019 Fintech Business Awards have been announced. Congratulations and good luck to all the finalists – both individuals and companies.

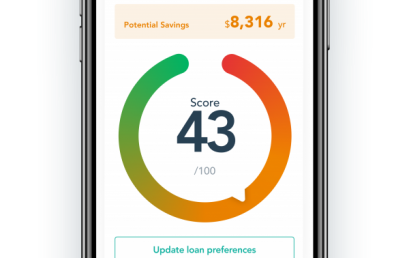

Know whether your bank is giving you a good home loan deal with uno’s loanScore

Australian fintech uno Home Loans is empowering customers to take back control with the launch of loanScore.

Bank sector transformation will come with open banking, competition: Xinja

Australian neobank Xinja said transformation of the financial services sector, described by Royal Commissioner Kenneth Hayne as often driven by greed, will only happen when consumers have clear choice, and can move easily and quickly between banks and other providers within the banking sector. The final report from the financial services Royal Commission paints a damning picture of the culture that drives Australia’s banks, with Commissioner Hayne imploring those who run Australia’s biggest and most profitable financial institutions to ‘obey the law’, ‘act fairly’ and offer services that are ‘fit for purpose’. “The reality is, the reason we’ve reached this low is that the sector has been controlled by a […]

Twitter founder Jack Dorsey: Crypto will deliver a global currency

Jack Dorsey has a lot of thoughts and plans for cryptocurrency. In a February 2 interview with Joe Rogan, the Twitter founder and CEO had a lot to say about the topic. In a wide-ranging interview that covers topics of censorship, app development, politics and other topics, Rogan steered the conversation towards Dorsey’s Cash App, which allows users to buy and sell Bitcoin Core (BTC). Rogan asked why Dorsey’s team introduced cryptocurrency exchanges in the app. Quite simply, Dorsey believes in a future of one global currency, if it is or isn’t BTC, and that starts in small steps. He said: “I believe the Internet will have a native currency […]

Ezidebit goes back to childcare roots after 12 months on the sidelines

Payments solution group Ezidebit is making an aggressive push back into the booming childcare industry after 12 months on the sidelines. Ezidebit provides an integrated payments solution to streamline collecting of fees for childcare centres and Outside School Hours Care services, reducing time spent in reconciling payments. Ezidebit has more than 20 years’ experience in the childcare industry, with a dedicated team to support the segment, but has been excluded from operating in the sector since the sale of partner QikKids in early 2018 where it was previously the exclusive payments provider. Ezidebit Managing Director Australia and New Zealand Mark Healy said: “Our heritage is in childcare and we fully […]

Is it time Australian investors bought into the fintech story?

By George Lucas, MD/CEO, Raiz Invest Tell Australian investors that a hole in the ground could prove to be the next El Dorado and they will fall over themselves to push a one-cent share into the stratosphere. But tell them about an exciting high-tech venture that is disrupting the market and you can hear the audible yawns. Raiz Invest’s former parent company, the privately-owned US company Acorns, recently raised $US105 million ($A145million) to continue to fund its operation. The Wall Street Journal reports this gives Acorns a $US860 million ($A1.186 billion) valuation. CNBC reports that Acorns US has more than 4.5 million sign-ups, 2.1 million investment accounts and circa $US1.2 […]

Australian regulator vows to tackle ‘cosy oligopoly’ of big banks

Australia’s competition regulator plans to wrest open the “cosy oligopoly” of the country’s four largest banks and punish misconduct via the courts, saying competition is the best way to fix the troubled sector. In an interview before the publication of a public inquiry report into the finance sector on Monday, Rod Sims, chief executive of the Australian Competition and Consumer Commission, said more competition was needed to protect consumers. Australia’s four biggest banks — ANZ Bank, Westpac, Commonwealth Bank of Australia and National Australia Bank — control more than 75 per cent of the domestic market. They enjoy lower funding costs than smaller competitors, due in part to an implicit government guarantee to save […]

First Growth Funds to emerge as force in crypto and digital assets investment

Diversified investment company, First Growth Funds (ASX:FGF), generated $160,584 in new income in the December quarter, with over half of new revenue generated from fees. The make up of new revenue breaks down as $86,000 in fees, $26,000 in dividends and interest and the balance in trading revenue. The numbers are indicative of First Growth Funds’ steady growth, along with its strict fiscal policy and its cryptocurrency and digital asset investment strategy. FGF invests across a broad range of asset classes and industry verticals, and is the only ASX-listed company that invests in the crypto and digital assets sector. The company leads the field in Australia with regard to crypto […]