Wisr tech upgrades lower average interest rate, drive growth and creditworthiness

Wisr, Australia’s first neo-lender (ASX: WZR), saw continued strong loan growth and customer acquisition in the first quarter of the 2019 financial year. Between July and September 2019 the company saw loan origination value grow by 49% when compared to the previous quarter, as well as 22% increase in overall loan volume. The result is the third consecutive quarter that Wisr has recorded quarterly loan growth in excess of 45%. The company also announced it had surpassed $50 million in loan originations since beginning operations, almost half of which were written from the beginning of 2018. Anthony Nantes, Chief Executive Officer, Wisr said borrower shift away from traditional lenders, brand […]

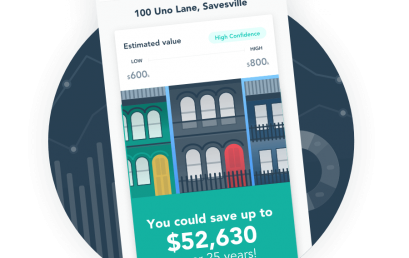

uno Home Loans appoints Anthony Justice as CEO

Online mortgage broker uno Home Loans has appointed Anthony Justice to the role of Chief Executive Officer. Anthony joins uno having spent the last decade in senior management roles in the financial services industry, including CEO of IAG’s Australian Consumer Division. uno Home Loans Chairman Abi Cleland said: “Anthony has extensive financial services experience; an impressive track record of leading and transforming customer-focused businesses; and strong alignment with uno’s values.” “We are delighted Anthony has come onboard to lead the charge as uno ramps up its growth trajectory and continues to shake up the home loan industry.” Anthony Justice said: “Getting a home loan is one of the biggest financial […]

Australia’s ‘first’ blockchain lender sets sights on mortgages

Australia’s “first” blockchain lender, which is set to launch next year, is offering a crowdsourced funding equity to brokers. Australian Mortgage Marketplace (AMM), co-founded by industry stalwarts Graham Andersen (CEO) and Kym Dalton (COO), has pledged to “overhaul” the Australian mortgage market with the “biggest change since the GFC” by funding prime loans on “Australia’s first mortgage securitisation blockchain”. According to the wholesale lender, which aims to be backed by major investors and industry super funds, its “Carbon” securitisation platform will leverage distributed ledger technology to deliver the benefits of increased transparency, security and automation. Its operating efficiencies will also reportedly present “pricing benefits” for Australian borrowers, enabling partner brokers to […]

uno cracks the formula for 10-minute home loan recommendations

Online mortgage broker uno Home Loans has introduced technology that delivers refinancers a credit proposal for a cheaper home loan in the time it takes to drink a coffee. Watch the video here. The new refinancing pathway on uno’s platform digitises the process to combine a property valuation; ID verification; instant credit check; collection of current loan details; verification of income, expenses and liabilities; and assessment with credit policies from nine lenders. This expedited process – which would take days with a traditional broker – addresses a major barrier to more Australians refinancing and saving. uno Home Loans Founder and Chief Innovation Officer Vincent Turner said, “Many Australians know they […]

Afterpay’s shares recover as the fintech backs greater regulation of buy-now-pay-later consumer lending

Payments fintech Afterpay, whose shares were hit hard after a Senate inquiry was formed to investigate consumer lenders not covered by the financial services royal commission, says it supports “appropriate regulation” and oversight by corporate regulator ASIC. The company says its buy-now-pay-later model is different to traditional credit, a fact recognised by the New Zealand Government when it recently decided not to include products such as Afterpay in local credit regulations. “Afterpay welcomes the opportunity to participate in any review to ensure an informed discussion takes place in an appropriate forum and that the differentiated nature of Afterpay’s service is clearly understood,” the company said on a statement. The fintech […]

Open banking: Refinance in 15 minutes

Open banking could see borrowers refinancing their home loans in 15 minutes, according to one panellist at a recent fintech summit. The event, held in Sydney on Tuesday (16 October), focused on how digital innovation was changing finance. The program included speakers and panel discussions on topics such as challenger brands, neo-banking and open banking. One panel session on challenger brands and neo-banks discussed the future of open banking. Panellists included CEO of VOLT bank, Steve Weston, and chief marketing officer of Athena Home Loans, Natalie Dinsdale. Athena Home Loans is still in a soft pilot phase, but Dinsdale said its “mission is to own home loans”. Other panellists were […]

ANZ in global banking consortium to digitise trade finance

ANZ Banking Group has joined forces with six global banking giants to create the “Trade Information Network”, which the lenders say will accelerate the digitisation of traditionally paper-based processes to unlock billions of dollars of funding for global exporters. “The network has the potential to transform international trade,” the banks said in a media release issued on Thursday, ahead of its official unveiling at the massive Sibos conference in Sydney on Monday. The other members of the new network are: Banco Santander, BNP Paribas, Citi, Deutsche Bank, HSBC and Standard Chartered. The banks want to develop a new industry standard for trade finance, which has been in a challenging period […]

Lendi announces co-major sponsorship of the West Coast Eagles

Online home loan platform Lendi, has announced a new partnership as co-major sponsor of 2018 AFL premiership winner, the West Coast Eagles Football Club.