Open banking’s first loan approved

Leading Australian fintech company Basiq has worked with Regional Australia Bank to have the first loan approved under open banking.

Former HashChing CEO unveils new venture

New fintech Effi launches to be the solution for “an industry long-suffering from declining revenue, inefficient processes and poor digital experiences”.

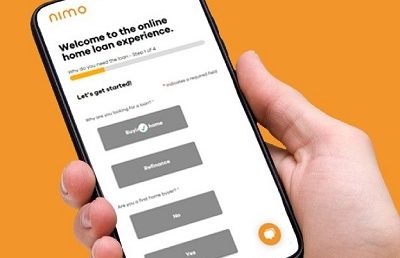

Nimo launches SaaS platform to help lenders provide home loans online

Nimo’s SaaS platform enables lenders to benefit from a digital-first, customised, cost-effective and scalable approach to home loan products.

Wisr returns to pre-COVID-19 loan origination levels

ASX-listed neo-lender Wisr announce that the company has returned to pre-COVID-19 loan origination levels.

Prospa reports strong Q3 but Q4 hard hit by COVID

SME lender Prospa has reported “solid” performance in the March quarter, but revealed it was “materially impacted” by COVID-19.

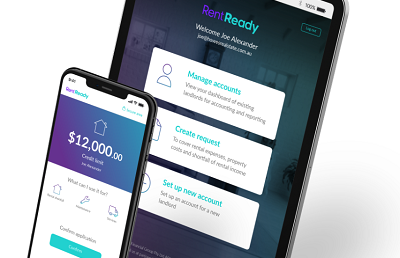

RentReady launches the first pay later solution in Australia for landlords

ASX-listed MoneyMe announce the launch of RentReady, a first to market pay later solution to help agents and landlords better manage investment properties.

Australian FinTech company profile #89 – Jacaranda Finance

Jacaranda Finance use risk based pricing to offer consumers a digital first personal loan product that is one of the fastest services in the country.

Q2 Cloud Lending helps GetCapital accelerate loans to Small and Medium Enterprises affected by Coronavirus

The Q2 Cloud Lending solution is focused on streamlining and digitising the loan process and can be set up and running within a week.