Volt bank to build mortgage platform with IRESS

Digital bank Volt has revealed a new partnership with veteran fintech vendor IRESS to build its customer-facing mortgage system.

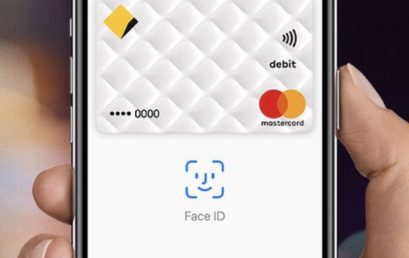

CBA expands Apple Pay to include business cards

CBA said the inclusion of business card holders is part of its drive to become a simpler, better bank with the latest digital offerings.

No more PIN payments as fingerprint-scanning bank cards launch in the UK

Biometric cards which enable people to verify payments using their fingerprint rather than needing to enter a PIN are now being trialled for the first time.

What does NPP mean for businesses and how on earth do they implement it?

86 400 secures national distribution with Vow Financial, readies home loan offering

From devolution to revolution: re-bundling the banks

Aussie fintech Volt Bank starts by asking consumers what they want

How Blockchain is boosting the Fintech Sector

The Financial Technology sector, commonly known as Fintech, has changed considerably over the years. From the introduction of ginormous super computers in the 1970’s that would struggle to compete with the average phone for power these days, technology has advanced the finance world. The 1980’s saw automated stock exchanges and the increased use of computer technology in everyday banking. The 1990’s brought the advent of the internet, changing our lives as well as the financial sector. Slowly but surely, mobile banking, internet banking, personal loans, insurance renewal, forex trading and more crept into our lives bringing disruption to the financial world. What was once the preserve of big banks and […]