Fintech 101: Core concepts for the future of banking

Everyday it feels like someone, somewhere has coined a new banking term. But as Australia continues to take big steps towards innovation, the average Aussie might feel left in the dark when it comes to understanding what’s in store for the future of banking. So to keep you in the loop with all the latest in fintech, we thought it might be worth getting the basics down first. What is fintech? Put simply, fintech stands for ‘financial technology’ and can refer to any technology that is used in the finance industry to provide products and services. Just remember that fintech usually refers to newer, innovative products and services. For example, […]

ANZ bank launches phone wallet to withdraw cash from ATMs

The days of carrying a plastic bank card could be numbered, with ANZ customers now being offered the option of ditching their wallet for an all-digital profile. The bank’s latest innovation is technology allowing consumers to use a smartphone or watch to withdraw their cash from an ATM. The move means all ATM functions can now be completed without a card, and follows the widespread use of devices to process payments and purchases. “It is more secure than plastic cards because customers have to either use their face ID, or thumbprint or pin on their phone before they can even use cash, and take the cash out at the ATM,” […]

Aussie banks dragged into the ‘open source’ era via GitHub

Financial policy making is getting the open source tech treatment, courtesy of Data61. The use of GitHub to manage the development of open banking technical standards represents a significant innovation in Australian policy making. GitHub, which is used by 28 million software developers around the world, was bought by Microsoft in June for $US7.5 billion ($10.5 billion). The open banking Data Standards Body, which is being run by the CSIRO’s Data61 unit, is using the online service to manage feedback and comments for the technical standards that will govern the movement of data in the new economy. All decision proposals and final decisions for the open banking standards will be […]

ACCC wants fintechs to improve data standards

The competition regulator wants fintechs receiving bank data under the government’s data porting regime to face tough penalties if they fail to meet stricter privacy standards that will be introduced to protect customers. Releasing a framework for rules to govern the new “consumer data right” (CDR) – which will begin with bank data and then be extended to telecommunications and utilities – the Australian Competition and Consumer Commission said its accreditation regime would require data recipients to be “fit and proper”, have “effective” risk systems to protect information and privacy, and to take out insurance to cover potential data breaches. Suggesting it will adopt a tougher approach towards open banking […]

The power to make corporate banking ‘beautiful’

Small businesses “simply want working capital. They want to know how much, how soon and what it will cost,” says Martin McCann, CEO and Co-Founder of Trade Ledger. As the Australian company establishes itself in Europe, Martin talks with FinTECHTalents about bringing the open banking revolution to corporate banking, overcoming the barriers of Excel spreadsheets with machine learning, AI and bots and plans to bring the winner of their upcoming ‘Code Challenge’ to Sydney. Trade Ledger was founded in 2016 – Why, what problem were you solving? The single biggest reason businesses fail is a lack of adequate funding – globally this equates to an under supply of credit of […]

Australia in driving seat as global blockchain standards take shape

Westpac director Craig Dunn will tell China this week that more engagement from its technology leaders will help the global standards-setting process for blockchain, which Australia is leading, to create guidelines that will reduce the cost of deploying the emerging technology across the global economy. An Austrade trade delegation arrived in China over the weekend ahead of this week’s Wangxiang Global Blockchain Summit in Shanghai. Australia is chairing the International Standards Organisation (ISO) group developing standards for blockchain and distributed ledgers and Mr Dunn is chairing the work. He told The Australian Financial Review ahead of a keynote address at the summit that “if you are going to have an […]

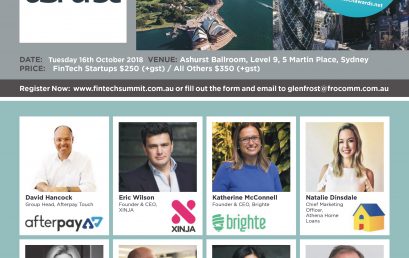

5th Annual FinTech Summit 2018: The Year of The Challenger and Neo-Banks!

5th Annual FinTech Summit 2018 – This is the Year of The Challenger and Neo-Banks! This year will see the launch of a number of ‘challenger’ and ‘neo-banks’ in Australia who will take on the Big End of Town. Remember – banks think they own the financial services sector because they have the customers and the distribution – the branch networks, and the (thousands of) financial advisors. Here’s the problem – all the new customers, the millennials, don’t trust the banks, or their advisors, and we haven’t yet heard the final recommendations of the Hayne Royal Commission – will there be criminal prosecutions? (Free Tip: It’s very hard to own […]

Irish fintech Priviti launches in Sydney as Australia prepares for Open Banking and the Consumer Data Right

As Australia prepares for its new Open Banking standards and the Consumer Data Right, Priviti, the global fintech company, is helping banks get ready to comply with new legislation and empower consumers with greater control over how their personal data is shared. Its extensive experience with global data protection laws such as PSD2 and GDPR means Priviti has seen the paradigm shift in the way financial organisations and individuals view their data, and how their systems need to change, explains Dermot McCann, Priviti’s Head of APAC. “Every day a bank is potentially engaging in new activities that could impair their compliance, particularly now in this new era of Australian Open […]