YTML opens Seido Financial Advice App Store

YTML will officially open the Seido Financial Advice App Store at the Association of Financial Advisers (AFA) Conference on the Gold Coast this week. YTML CEO, Kevin Liao said Seido, which has already attracted various providers including SuiteBox, AstuteWheel, Omnium, ChantWest and customised offers, enables Apps which have been designed for each stage of the financial advice process to work together to create client-friendly, succinct and compliant advice documents in a fraction of the time it currently takes. “In this sense, the Seido App Store moves beyond what we traditionally think of when we think of App stores,” Mr Liao said. “It is designed to not only act as a […]

Specialist lender encourages brokers to think fintech

Fintechs are disrupting the way people bank, from moving money around accounts to applying for mortgages. While some are concerned about keeping pace with these technologies, or what it may mean for regulation, others are welcoming the changes. One such pioneer is Liberty which says the emergence of fintechs has enabled growth, praising their appetite to take risks and try new things. Liberty group sales manager, John Mohnacheff, encourages others to embrace new ideas, as it enables businesses to grow and develop. “At the core of our business is innovation and it’s a delight to be joined by entrepreneurs who are also experimenting with different ways of doing things,” he […]

Australia and US strike deal to share fintech trends and developments

Information-sharing on fintech market trends will be easier between Australian and US companies as a result of a new agreement signed between the two nations. The Australian Securities and Investments Commission (ASIC) and the US Commodity Futures Trading Commission (CFTC), which protects market users and their funds, consumers, and the public from fraud, signed the Cooperation Arrangement on Financial Technology Innovation. On top of focusing on sharing information on fintech market trends and developments, the arrangement will also facilitate referrals of fintech companies interested in entering the others’ market, and sharing information and insight derived from each authority’s relevant sandbox, proofs of concept or innovation competitions. ASIC chair James Shipton […]

Gen Z using tech to become finance savvy

Young people are using money in ways unheard of a generation before. They have never known a card that doesn’t tap and go, or a phone that can’t control every aspect of their financial lives. While many pass off Gen Z as just an extension of the “smashed avocado” generation, some commentators say they have a very different mindset to Gen Y and are more savvy about how they spend and invest money. Dale Gillham, executive director and founder at Wealth Within, a financial services and education company, says: “A few years ago nobody under 30 would talk to us to much,” he says. “Now we’re finding that under 25s […]

Perth Mint’s GoldPass app for tech-savvy Gen Y traders

Perth Mint boss Richard Hayes hopes the State-owned entity can attract tech-savvy millennials with its new gold trading smartphone app. GoldPass is a secure investment platform that allows people to buy, store and sell gold and transfer the precious metal to others via digital certificates with real time settlement. The digital certificates are backed by physical gold stored at the Perth Mint and its network of central bank-grade vaults. There are no storage fees but the mint makes money via brokerage fees ranging from 0.2 and one per cent depending on the size of the transaction. Mr Hayes said the mint already had a solid customer base, generally made up […]

Neobanks are coming: What the revolution means for you

For the first time the big four Australian banks are about to face several new challengers at once as a group of ‘neobanks’ promise to change the way you manage your money. Eric Wilson was a senior executive at NAB, getting nagged by his father-in-law, a former bank manager for the Bank of New South Wales when he decided he’d had enough. “He used to always say to me ‘Eric, why is banking like this? It used to be about people but now it’s just about screwing people for as much money as they can,” Wilson tells Your Money. “Eventually I had a bit of an epiphany when I was […]

Fintech Investment Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2018-2025

Global Fintech Investment Market to reach USD 152.94 billion by 2025. Global Fintech Investment Market valued approximately USD 39.6 billion in 2017 is anticipated to grow with a healthy growth rate of more than 18.40% over the forecast period 2018-2025. The growth of an alternative business model that can both replace and complement traditional payment practices is a key growth driver for the fintech market growth. Major banks are helping to incubate, invest in, or partner with FinTech companies. For instance, Oradian, a software provider caters to organizations that offer financial services to low-income individuals. Oradian develops core systems that help microfinance institutions manage their clients efficiently and facilitates day-to-day […]

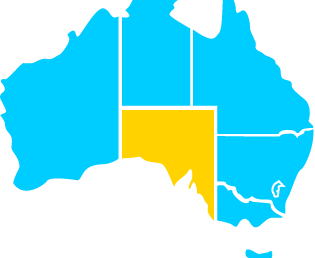

South Australian Premier Steven Marshall hopes to build blockchain hive

South Australian Premier Steven Marshall is eyeing the blockchain technology industry as one of the future growth engines of the state’s economy and wants a cluster of companies to eventually settle in a hub on the site of the old Royal Adelaide Hospital. Mr Marshall said there was a first-mover advantage to be had in such a young industry and he wanted to grasp it. However, he would not be offering any financial incentives to entice individual companies to set up on a part of the former hospital site known as Lot 14, which is being promoted as an incubator of technology and creative industries on a prime city site […]