Frollo leads Australia into new era of the Consumer Data Right with first access to Open Banking data on launch day

With Open Banking data, Frollo can help consumers identify when they are missing out, paying too much or should switch to a better deal with their bank.

Former HashChing CEO unveils new venture

New fintech Effi launches to be the solution for “an industry long-suffering from declining revenue, inefficient processes and poor digital experiences”.

COVID-19 is a chance to rebuild Australia as a digital leader

Instability throughout most of the world during COVID-19 is giving Australia the opportunity to emerge from the recession as a digital leader.

Digital evolution must happen across insurance ecosystem

Digital innovation and technological advancement has to happen across the entire insurance ecosystem in Australia.

Australian FinTech company profile #93 – Send

Send are delivering a truly global payments platform to our customers and partners that connects people with their money like never before.

10 questions from Frollo’s webinar: Comply and Compete with Open Banking data

Here is an update and 10 questions from Frollo’s recent webinar: Comply and Compete with Open Banking data.

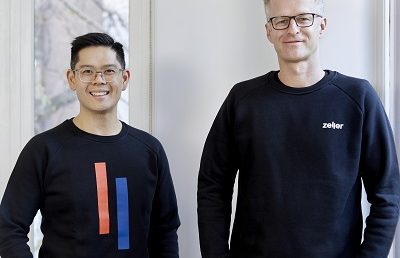

Australian fintech Zeller raises $6.3m to reimagine business banking

Former Square executives, Ben Pfisterer and Dominic Yap have unveiled Zeller, a new company focused on offering a true alternative to business banking.

MyNextAdvice supports financial advice industry with compliance solutions

MyNextAdvice is developing additional solutions to help financial advice and mortgage broking businesses deal with their growing compliance obligations.