Lendi named as one of LinkedIn’s top startups

Leading online home loan platform, Lendi, has been recognised in the 2018 LinkedIn Top Startups list, honouring the 25 most sought-after startups in Australia. The LinkedIn Top Startups list celebrates the companies and people making an impact in the professional world. The list is derived from a blended score looking at factors including interest in the company, engagement with employees, job interest and retention, and is informed by the billions of actions taken by more than 575 million professionals on LinkedIn. “At Lendi, we put people at the heart of everything we do. To be featured on Australia’s first LinkedIn Top Startups list is a significant milestone for us. It […]

Stone & Chalk startup Metamako is acquired by Arista Networks

Arista Networks, an industry leader in software driven cloud networking solutions for large datacenter and campus environments, today announced that it has acquired Metamako, a leader in low-latency, FPGA-enabled network solutions. Arista achieved early success in the financial services market with low-latency cloud networking. Arista’s ultra-low latency switching platforms combined with EOS® (Extensible Operating System) enables resilient cloud networks for transporting data, multi-media, storage and compute traffic. The acquisition of Metamako will play a key role in the delivery of next generation platforms for low-latency applications. “It’s with great pleasure that we bring Metamako’s award-winning, ultra-low latency technology to the Arista family of platforms,” said Anshul Sadana, Chief Customer Officer for Arista […]

Prospa top fintech in 2018 LinkedIn Top Startups List

Prospa has been named 6th on the 2018 LinkedIn Top Startups List, which honours the 25 most sought-after startups to work for in Australia. Prospa is also the highest placing Fintech in the ranking. The LinkedIn Top Startups list is derived from a blended score looking at factors including interest in the company, engagement with employees, job interest and retention, and is informed by the billions of actions taken by more than 575 million professionals on LinkedIn. Now in its sixth year, Prospa has established itself as a leader in the online small business lending space. Prospa has delivered consistent high growth with customer satisfaction highlighted by an NPS score […]

MyPrivateBanking 2018 global report ranks Ignition Advice #1 innovation and flexibility

MyPrivateBanking, one of the world’s leading independent financial services research houses, has named Ignition Advice as the world’s most innovative and flexible robo-advice solution. Headquartered in Kreuzlingen, Switzerland, MyPrivateBanking Research is an independent firm specialising in research and analysis for wealth managers and financial services firms. With more than two decades of experience MyPrivateBanking boasts a team of highly experienced analysts and industry experts. “Ignition offers a strong product proposition and offers the entire spectrum of services demanded by this industry, making it a strong and dependable partner. The solution offers a wide range of customisation capabilities across the spectrum of business needs. In particular, the approach to content and […]

Applications open for the prestigious New York Immersion Program for FinTechs scaling up into the USA

FD Global Connections, which works with organisations to launch their businesses in the USA, today announced applications are open for its prestigious New York Immersion Program targeting FinTechs, RegTechs and InsurTechs ready to scale up into the US market. There are only limited places available for the exclusive opportunity to get in front of some the New York’s leading investors, customers, mentors and industry-leading professional service providers. The program provides an enormous head start into a market that is often considered remarkably challenging to break into. The New York Immersion program run by FD Global Connections, is in partnership with Tyro FinTech Hub (www.tyrofintechhub.com) and supported by Australian FinTech (www.australianfintech.com.au). […]

Prospa becomes first online small business lender to complete review of loan terms with ASIC

Prospa is the first online small business lender to have undertaken a full review of its loan terms after consultation with ASIC. Prospa has agreed to certain recommendations from ASIC in relation to removing or amending some of its contract terms. Some of these terms have, historically, not been relied upon, and other terms were amended to clarify or reflect existing policies. Prospa notes that the amendments agreed with ASIC do not have any material impact on the company financially or operationally. Prospa’s COO Ben Lamb said: “We’re always looking for ways to improve finance outcomes for small business owners. As the first non-bank lender to complete its review, we […]

Australian Fintech companies do it again in this year’s Anthill Magazine Smart100 2018

Once again the Australian Fintech industry has been well represented in this year’s Anthill Magazine Smart100 2018. Congratulations to the all the Australian Fintech companies who made the Smart100 list for 2018: Trade Ledger Practice Ignition eBroker Link4 For the full list of Anthill Magazine Smart100 2018 winners, please check them out here.

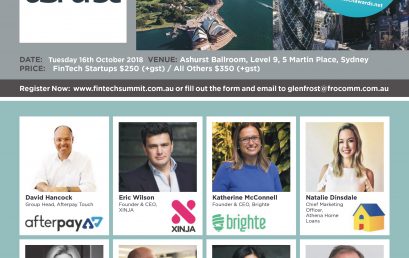

5th Annual FinTech Summit 2018: The Year of The Challenger and Neo-Banks!

5th Annual FinTech Summit 2018 – This is the Year of The Challenger and Neo-Banks! This year will see the launch of a number of ‘challenger’ and ‘neo-banks’ in Australia who will take on the Big End of Town. Remember – banks think they own the financial services sector because they have the customers and the distribution – the branch networks, and the (thousands of) financial advisors. Here’s the problem – all the new customers, the millennials, don’t trust the banks, or their advisors, and we haven’t yet heard the final recommendations of the Hayne Royal Commission – will there be criminal prosecutions? (Free Tip: It’s very hard to own […]