Fintech unveils mortgage under 3.5%

Fintech and online lender loans.com.au has unveiled its newest home-loan offering for owner-occupiers with a low interest rate of 3.48%. Dubbed the Smart Home Loan, the mortgage product is a principal-and-interest loan that has no ongoing fees and has a comparison rate of 3.5%. The product has a maximum loan amount of $1m and has several features such as redraw facilities and the ability to split and make additional repayments. Homebuyers can borrow as much as 80% of the value of their targeted property. Loans.com.au managing director Marie Mortimer said the new home-loan product aims to drive competition in the mortgage space and provide other options for borrowers who are […]

St.George customers can now use Google Pay to withdraw cash

St.George, BankSA and Bank of Melbourne customers can select cheque or savings when using Google Pay to withdraw cash at the checkout. EFTPOS has today announced it’s expanding its service to Google Pay with St.George, BankSA and Bank of Melbourne. The partnership means that customers of these participating banks can use Google Pay on their Android smartphone to withdraw cash at the checkout of participating stores, all without their physical debit card. The partnership enables customers to select savings or cheque when making contactless purchases with Google pay, meaning the transaction will be processed as an EFTPOS transaction rather than going through as credit. Just like when you use your […]

Australian regulator trials Blockchain to Automate Transaction Reporting

An Australian financial regulator is trialing blockchain technology to automate reporting of cross-border transactions by institutions. ZDNet reported Sunday that the Australian Transaction Reports and Analysis Centre (AUSTRAC) has partnered with the Swinburne University of Technology in Melbourne to build a prototype for the trial. The two partners will specifically examine how blockchain and smart contracts, as well as other technologies, can help entities such as banks to automate reporting of international funds transfer instructions (IFTIs) to the regulator. Australia’s Anti-Money Laundering and Counter-Terrorism Financing Act mandates that institutions or specific categories of individuals involved in a cross-border transfer of funds – including payer, sender and beneficiary institution – must report […]

The Samsung Galaxy S10 has a cryptocurrency wallet built in

Samsung is one of the first major smartphone makers to include a cryptocurrency wallet in its latest flagship Galaxy S10 phones. The wallet lets users store bitcoin, Ethereum, and a beauty-related cryptocurrency called Cosmo Coin. It’s a cold storage wallet, meaning it’s not connected to the internet. The Galaxy S10 phones also support select decentralized apps (“Dapps”). Currently, Samsung’s main Dapp that’s available is called Cosmee, and it lets users earn Cosmo tokens in exchange for leaving beauty reviews in the app. Cosmochain, the South Korean blockchain startup behind Cosmee, describes its app to The Verge as a blockchain-powered beauty review app — the blockchain is supposed to be a […]

Make money while you sleep with technology and automation

Technology and automation are delivering Australians new ways to earn money while they’re sleeping.There has been rapid growth in new savings and investment products that allow people to start building wealth with a few taps of their smartphone or computer keyboard, then let the power of compound interest do its work.Here are four ways to get rich automatically. ROUNDING UP Fast-growing financial technology company Raiz automatically moves its clients’ spare change to an investment portfolio or superannuation. It rounds up every transaction to the nearest dollar, and now manages more than $270 million of people’s funds, up 60 per cent in the past nine months. Raiz managing director George Lucas […]

Five tips for getting the most out of your equity crowdfunding campaign, from founders who have been there

Since equity crowdfunding launched in Australia in 2017, startups in their droves have looked to the public to help take their venture to the next level — albeit some more successfully than others. But from the modest to the multimillion, what is it that made the successful raises successful? These founders have all been there, and they’ve got some advice. Make the most of your community Sonya Stephen, founder of cinema ticket startup Choovie saw equity crowdfunding as a way to turn her “fabulous customers” into investors, giving the community of users a chance to be more involved in the business When business-to-consumer interaction is important to a startup, “crowdfunding […]

Legally certified identity verification solution ‘light years ahead’ of the market

Max ID®, an Australian Legal Practice and Reg-tech innovator, has been named as a finalist for the Fintech Business Start Up of the Year and Compliance Innovator of the Year at the Fintech Business Awards 2019. The Fintech Business Awards, one of the leading awards programs in the Australian technology sector, celebrates the leading individuals and organisations who demonstrate outstanding innovation and entrepreneurship. In late 2018, after testing and piloting with a number of clients had been successfully completed, Max ID publicly launched the solution that brings a broad range of industry players a step closer to their aim of delivering simple, efficient and inexpensive same-day fully compliant ‘safe harbour’ […]

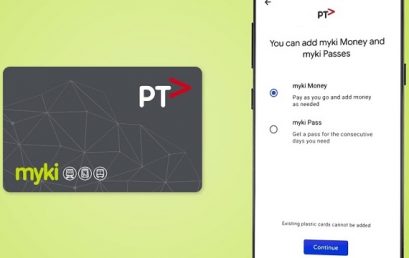

Modern myki miracle: Android users give thumbs up to mobile payment trial

It has all the makings of a public transport miracle: a rollout of new myki technology that isn’t plagued by huge problems. At least not yet. Commuters taking part in a smartphone myki payment trial have given the beta test a cautious thumbs up, heaping praise on the convenience of topping up remotely and the system’s decent touch-on speed. Android users started using their mobile phones to pay for fares on Victoria’s trains, buses and trams after Public Transport Victoria invited 4000 people to take part in the test-run last month. There is still work to be done to ensure everyone can benefit: iPhone users remain locked out of the […]