What Apple’s credit card means for Fintech

To the traditional financial sector’s dismay, nightmares have become reality and Apple is now a banking player. After years of discussion about whether Big Tech corporations will enter this domain, details of a payment card were unveiled, threatening to blow all other newcomers out of the water. Apple Card, launched in partnership with Mastercard and Goldman Sachs, will leverage the success of Apple Pay and will be available as a built-in feature within the Apple Wallet application on iPhone. Boasting the promise of a “healthier financial life,” the new credit card will also offer 2 percent cashback on all transactions – which they will receive on a daily basis, making […]

Pay-passing the hat around: From buskers to churches, a cashless society is Australia’s future

It’s becoming ever more apparent that as a society, we’re veering more towards being completely cashless, with solutions for giving and receiving money continually popping up and challenging everything we thought we knew about transacting. Not only is new technology and state-of-the-art security helping to boost consumer confidence when it comes to transacting electronically, but financial technology or ‘fintech’ is streamlining our financial interactions — making it easier and more reliable than ever before. According to the RBA, in the early-2000s, Australians went to an ATM an average of 40 times per year, but today, we go to an ATM about 25 times a year — a downward trend that is […]

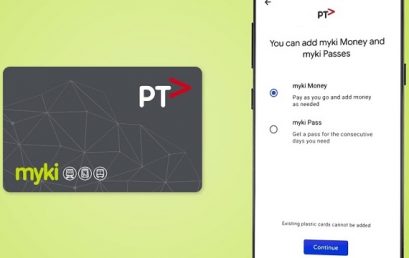

Melbourne commuters will soon be able to ditch their Myki and use their mobiles instead

Melbourne commuters will be able to ditch their Myki and use their Android smartphones to pay for public transport starting Thursday, but users of Australia’s most popular smartphone, the iPhone, are going to have to wait. Android users will be able to use Google Pay to handle their public transport expenses with a minimum top-up of $10, Public Transport Victoria said. This will remove the need for users to physically carry their Myki card. As long as the user is running the Android 5.0 operating system and has a near-field communication chip for contactless transactions, they’ll be able to use the system. Apple smartphone owners will have to wait for […]

Asia Pacific look towards embracing technologies to advance their digital transformation strategy: F5 Networks survey

Asia Pacific organisations are keenly taking advantage of embracing emerging technologies to accelerate their digital transformation projects. F5 Networks’ (NASDAQ: FFIV) latest 2019 State of Application Services report revealed that 41 percent of Asia Pacific organisations are employing containers, and taking advantage of agile development methodologies to deliver applications smarter and faster. While such shifts present new opportunities for automation and agility, complexity levels also arise; leaving organisations with additional challenges such as enforcing consistent security and optimising reliable performance standards. “As Asia Pacific businesses look to further advance their ongoing digital transformation initiatives, the ability to modernise its application portfolio and infrastructure is taking center stage,” said Adam Judd, Senior […]

Digital wallets at ‘tipping point’, says ME Bank

The use of digital wallets is at a “tipping point” and customers will soon expect all banks to provide such services, says Members Equity Bank, as its decision to develop the smart phone technology dented first-half profits. As the lender delivered results that showed it was winning market share but facing skinnier profit margins, chief executive Jamie McPhee also said he thought the housing downturn had further to run, tipping house price falls of another 5 to 10 per cent. The industry-fund owned bank, known as ME, booked a $5 million impairment in its first-half result as it stopped work on its credit card platform to divert funds to work […]

Future of advice: boutiques for some, robo-plans for the rest

Westpac chief executive Brian Hartzer says the growing cost of providing personal financial advice, including sky-rocketing regulatory costs, is creating a bifurcated financial advice market, with specialist boutiques serving customers willing to pay more for bespoke plans, while banks – sensitive about their reputations following the Hayne inquiry – shift to an automated model supplying general advice to the masses. After Westpac announced it would no longer provide personal advice, leading wealth advisers also said the traditional model of major banks seeking to provide cheap, personalised advice funded by cross-selling products was now dead, following the royal commission, and agreed “robo advice” would emerge as the way of delivering financial […]

“Play to your strengths”: Why Airwallex’s Lucy Liu rejects labels in startupland

She may be a leading woman in Australian startups, with her business pegged to become another local unicorn, but Airwallex co-founder Lucy Liu doesn’t like to think in labels, preferring to focus on her strengths and successes than her gender. Founded in Melbourne in 2015, Airwallex secured $109 million last June, in one of 2018’s biggest capital raises. Since then, Liu and co-founder Jack Zhang have been focusing on growing the team, and have opened three new offices. The business has been moving quickly, Liu tells StartupSmart. “Startup years are like dog years,” she says. “You have seven years’ worth of stuff in one year.” Last year, Liu took home […]

An accountant’s guide to comparing Fintech business loans

How can you objectively compare the loan pricing metrics between the different online business lenders and make the most informed decision possible? Assisting your small business clients with finance can be challenging with so many options out there from both banks and newer alternative finance providers. As traditional lenders have tightened their credit conditions and pulled back on SME lending, the rise of online, fintech lenders is providing small businesses with new opportunities to fund their growth. However, how can you objectively compare the loan pricing metrics between the different online business lenders and make the most informed decision possible? The answer is with SMART Box™. The SMART Box™ Loan […]