Till Payments introduces 20-week equal paid parental leave policy

Till Payments is going above and beyond industry benchmarks when it comes to inclusive parental leave policies to ensure no one is left behind.

86 400 to become part of the NAB family for $220 million

Digital bank 86 400 has today announced its intention to combine with UBank and become part of the NAB family for $220 million.

Fintech Brighte bags $100 million to “go deeper” on energytech

Fintech and energytech startup Brighte has rounded out the year with a massive $100 million raise, as it introduces a new business model.

Blockchain-based platform for bank guarantees set for commercial launch

ANZ, CBA, Westpac, IBM and Centre Group’s successful Blockchain platform, Lygon, reduces the time to issue bank guarantees from up to one month to one day.

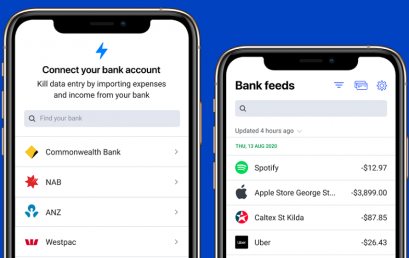

Going solo with banking data

Access to banking data via partnering with Basiq will also allow Rounded to add features such as automatic reconciliation in the near future.

Australian FinTech company profile #46 – Axe Group

Axe Group designs and builds innovative adaptable insurance software for Life and P&C insurance companies that deliver change today, without limiting what you can do tomorrow.

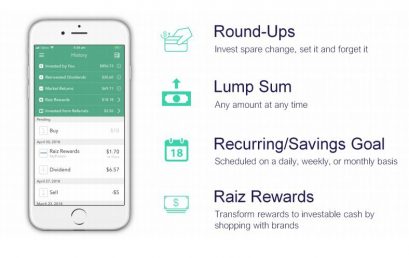

What is micro-investing and is it worth exploring?

Back in the day, if you were looking to save up your spare change, you’d look to the ol’ faithful piggy bank. But, nowadays, as cash is slowly becoming obsolete, some are turning to micro-investing as the modern-day answer to the piggy bank. And with micro-investing apps, not only can you save up your chump change but you can invest it. How does micro-investing work? Micro-investing is about making small and irregular investments from everyday transactions. Micro-investing apps round-up your purchases to invest your spare change. For example, a large cappuccino at $4.50 will be rounded-up to $5 and the 50 cents would then be invested. Depending on how frequently […]

The app increasing your super while you spend

A new phone app is helping people get big returns on their retirement savings, and Nine News has revealed how you can start earning NOW with as little as five dollars. A new app called Raiz is helping consumers use their spare change to boost retirement savings through an easy-to-manage investment account. And former financial advisor Nathan Martyn said he has already saved hundreds. “I wanted to start paying attention to where my super was and how it was likely to generate over time,” Martyn told Nine News. Say Martyn uses his debit card to buy a coffee for $3.50, the figure is rounded up to the nearest dollar. In […]